The Guardian newspaper in London published an article last week that suggests that children of upper-middle-class families are having to attend public universities because they are too affluent to receive need-based aid and they aren’t getting scholarship from private institutions.

What the reporter, who happens to be the wife of Bill Keller, the former editor of The New York Times, doesn’t seem to realize it that outside the East Coast bubble, there are plenty of colleges and universities that provide merit scholarships to students who don’t qualify for financial aid. Many of the most elite schools on the East Coast, such as the Ivies, don’t give merit scholarships because they don’t have to. Wealthy students flock to those schools without carrots.

A Teenager’s Merit Scholarship Offers

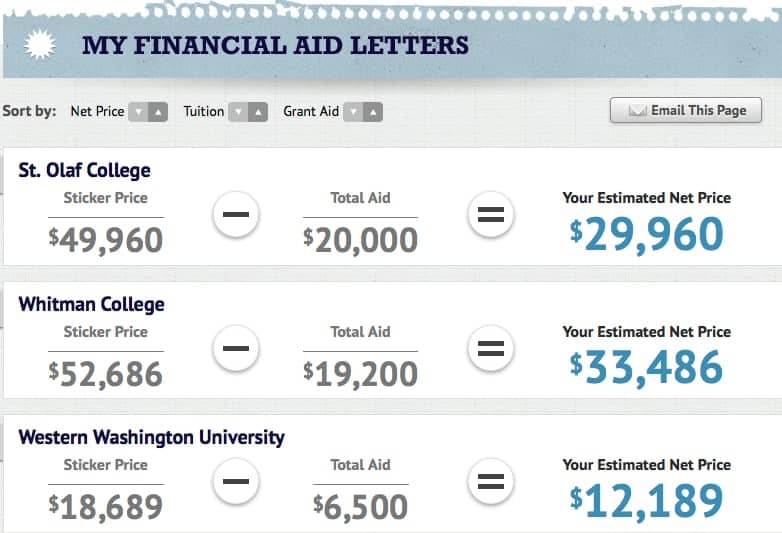

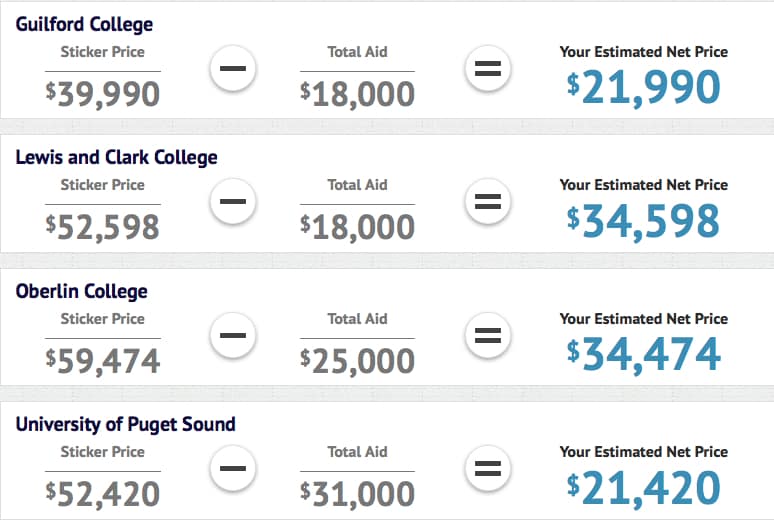

On the same day that I was reading the Guardian article, I received an email from an upper-middle-class parent, who wanted to share the results of her daughter’s college search. Unlike the families in the Guardian article who got stiffed, the teenager from the Pacific Northwest received many merit scholarships.

The teenager applied to eight schools:

- Western Washington University

- University of Puget Sound

- Guilford College

- St. Olaf College

- Ursinus College

- Whitman College

- Oberlin College

- Lewis and Clark College

Here is what the mom shared with me:

Our FAFSA Expected Family Contribution is just under $26,000. Thanks to your advice, and with some additional convincing from Loren Pope’s books, she chose to apply to schools where she thought she would be welcome and which we thought would offer at least some merit aid.

All of the private colleges offered $13 – $25 K in academic merit awards.

– Puget Sound offered a $12K music scholarship in addition to an academic award ($19K) commensurate with the others, which makes its price very attractive!

– Guilford College (where a friend is very happy) has a much lower sticker price than the others, so comes in at a reasonable price.

– Whitman was the only school that offered my daughter a need-based cash award. With the academic award, the aid offer is $19,200.

– Ursinus, Lewis & Clark, Whitman, and Oberlin all offered subsidized loans and work-study in addition to the awards.

An Strategic Search for Colleges

The mom used College Abacus to put the offers in a form that could be compared. If you don’t know how to use College Abacus, check out my previous post:

College Abacus: Deciphering Financial Aid Awards

Bottom Line:

1. This family’s search illustrates what can happen if you look for colleges strategically while keeping costs in mind from the start.

2. Families counting on merit scholarships must throw a wider net. As I’ve mentioned before many of the best value schools are located in the Mid-Atlantic (look at the Guilford deal!), the Midwest, South and interior West.

3. Students should also look for institutional scholarships for their talents or particular majors just as this teenager did which resulted in a handsome award from the University of Puget Sound. These scholarships, which often require a separate application, often have less students pursuing them than the less lucrative private scholarships.

When my son received his Western Washington University merit-based scholarship, I initially didn’t notice the fine print — most of the award was only valid for the first year of school, the rest of the amount was only valid for the first two years of school. This “front-loading” of financial aid is a deceptive practice. They do it for two reasons:

1. Their website financial aid calculator computes the expected “freshman year” cost, which most parents incorrectly assume can be extrapolated to all four years, so they appear to have a lower cost by applying a large award to just the freshman year.

2. They hope people won’t notice that the award only applies to the first year (or two).

So, at least in the case of Western Washington University, the amount printed above in this article is likely incorrect. Most likely the student’s cost would have gone up to close to the full amount after the freshman year.

I can only wonder whether other colleges engage in similarly deceptive practices.

Just back from a Midwest tour with our high school junior (Denison, Macalester, Kenyon, and Grinnell which are being added to his last of Whitman and Willamette, so these are the schools he’s applying to next year). Everywhere we went people asked if we we also looking at Carleton, where his uncle went and was very happy, and we said no. No merit aid at all just makes it too expensive to consider. (This son is a likely NMF, near-perfect SATs, debater, very intense, wants weather–Carleton might well have been an excellent fit.)

I love the democratic ideal of meeting all need, but I think it does mean the schools lose another segment of the population who needs some help to bridge the gap.

We had a similar strategy with our oldest, now a freshman at Puget Sound and very happy. And with the merit aid, it’s a comfortable financial fit for our family. He’ll graduate debt-free, which was our goal. (Huge fans of Puget Sound, btw–he’s got tons of involvement, no problem getting classes, school is very friendly.)

We’re in the Northeast and just took a trip south to see some schools with our son. We’re also casting a wider net as we are in that range where we won’t get the need based aid but can’t afford the $55K sticker price for a private school for all 3 of our kids. I couldn’t agree more with your comment that schools are losing a segment of the population as I know many families who won’t even consider a private school. I believe the financial aid formulas have become too skewed and that its considerably easier for a for a family making $50,000 less than us to send their child to a private school than it is for people in our income range.

We toured Elon University in NC and they seems to take a different approach. The full cost of attendance this year was about $38,000, but they give very little in aid (both need based and merit) compared to other private schools. At this point, my guess is that he’ll end up at either Elon or Uconn, our state university.

I have also found that applying to schools where my daughter was above the middle 50% for ACT/SAT and GPA resulted in the best merit scholarship offers. She had 6 schools where this was the case and the merit offers ranged from $9,000 – $20,000. Most of these were Midwestern schools that were somewhat selective to rather selective, but would not be considered to be in the “most selective” category by any of the well-known college ranking lists. Our feeling was that cost of education needed to be high on the list of considerations in order to get the best overall deal and avoid any loans. As long as a school offered a good honors program, we felt that the quality of education she would receive would be on par or close to that offered by costlier top-tier schools.

Yes Wendy that is an excellent strategy that I should have mentioned.

Lynn O’Shaughnessy

I have been following your advice about these schools and the “wider net” idea- Unfortunately, geography is an issue for us as my daughter really wants to stick close to home in NY. Traveling more than 3 hours away is not for her. Any thoughts ? I will have to go back and read your posts on the northeast and just keep doing comparisons. Thank you for so many great tools!

Hi Lynn,

From my experience (of the past few months only) I completely agree with you about getting better aid from colleges that are not as well known and in areas that are less in demand. We’re in SoCal, too, and my son applied to 11 mostly small colleges and got into 7 of them. Our EFC is fairly high and so I was surprised by the amount of merit aid he has received.

Overall, by far, the best merit aid was offered by colleges in the Midwest and way-north Northeast. The only private school he applied to in Calif, St. Mary’s, offered very little and would have saddled him with huge debt. But for 4 of the others in Michigan, Ohio, Vermont and North NY, he may not need any loans. All of his schools are highly regarded liberal arts colleges with similar admissions standards; geography is the only differentiating factor that is obvious to me.

Lynn,

Are music scholarships only for those students that are choosing to pursue music at a collegiate level?

Great Blog and thanks for you work. I will be buying your book soon. My daughter is a freshman and I have little time, but tempus fugit.

I’m the mom described in Lynn’s post. The music scholarships she was offered were for majors and non-majors alike. The only requirements: the student continue to take private lessons (tuition paid in addition to the additional cash) and that they participate in an appropriate collegiate ensemble. She is considering double majoring in music and a science, but did not commit.

Thanks for clearing the music scholarship issue up! Every school can have different requirements for its scholarships. A great resource to find these talent scholarships is at MeritAid.com and, of course, check on a school’s website.

Lynn O’Shaughnessy

Thanks Dorothy! My daughter is a trombone player and is a moderately advanced player for her age and she really enjoys it. I don’t think she will be a music major but I do think she will continue to play.

We have found that our son fit into this same situation as well. Our EFC was (unrealistically) too high to qualify for need-based aid, despite the fact that we needed it and the EFC figure was grossly inaccurate when you factored in our real-life real-world expenses that were not reflected in their questionnaire. He applied to 13 schools and got into 5. He was qualified or over-qualified for all 13 on paper, and some of them were head-scratchers when he didn’t get in. The two private schools on the East Coast offered need-based aid but even with that, it did not offset the $63,000 price tags of the schools enough to remotely make a difference. He ended up choosing one of our state public universities, which offered zero aid, but still came in nearly $9,000 less than either of the private ones on the East Coast. (And that’s before airfare!!) The private one here in SoCal where we live came in the same as the UC schools, and their aid was 100% merit-based. None of the schools he applied to otherwise offered any merit-based aid despite outstanding GPA, great SAT scores, challenging AP load, extracurriculars and leadership positions. At the end of the day, what we’ve decided is any school is what the student chooses to make it be. It’s really within them to get involved, to challenge themselves, to forge relationships with faculty and seek out opportunities. Too much weight is placed on prestige in this whole process, and kids can feel so let down when the “big name” choices don’t come through. For our family, at least, the financial aspect and the true quality of the program became the bottom line. In the end, it was not worth the stretch for the “prestigious” school because the program was truly better at the public university closer to home. Look at more than just the name, because it can only get you so far, and it’s not always worth the mountain of debt you may take on.

Dear Robin,

Could I please get the name of the college in Southern CA that you chose for your son?

Thank you!

JDC

Two liberal arts universities in SoCal that offer merit aid are USC and Chapman University. Chapman offers a 50% merit aid package to applicants with a certain GPA and above. My daughter was offered this package which covers not only tuition but also room and board (as long as you live on campus).There are several Christian colleges in SoCal that offer generous merit aid such as Biola, Azusa Pacific, Cal Lutheran, Cal Baptist, and University of San Diego, to name a few.