Parents are often worried about how their assets will impact their chances for financial aid.

Often their fears are overblown because financial aid formulas don’t penalize families for all their assets. But it is true that families are now experiencing a harder time protecting their assets from financial aid calculations because of a horribly flawed federal formula that needs to be changed.

I’ll explain the harm that this old formula is causing families, but first some background on the two big aid formulas.

Financial Aid Formulas and Assets

The reason why assets are often not a deal breaker when seeking financial aid is because of this reality:

The nation’s two main financial aid formulas don’t penalize parents or students for the money they have invested in qualified retirement accounts such as Individual Retirement Accounts, SEP-IRAs, 401(k)s, 403(b)s, KEOGHs and pension plans. You could have $1 million dollars parked in an IRA and it wouldn’t hurt your child’s chances for need-based financial aid at the vast majority of schools.

Main Financial Aid Applications

The formulas are linked to these two applications:

Free Application for Federal Student Aid (FAFSA)

Anyone hoping for federal and/or state aid or wanting to obtain federal college loans must complete this application. Most colleges also use the FAFSA to determine who will qualify for their in-house grants.

The FAFSA is a transparent aid application. You can see just what factors are assessed when the government releases is yearly formula. Here is the current one:

The EFC Formula, 2015-2016

The EFC Formula, 2015-2016

What you’ll notice if you take a look at the federal formula is that it also doesn’t inquire about whether you own a primary home. This is another reason why family assets are rarely an aid deal breaker. Most people have the bulk of their wealth in their home and their retirement accounts, which the FAFSA ignores.

CSS/Financial Aid PROFILE

The PROFILE is the College Board’s financial aid application that is used by roughly 260 colleges and universities that are nearly all private.

These schools, including the nation’s most elite institutions, rely on the PROFILE to determine which students will receive need-based financial aid from their schools. These institutions still use the FAFSA, but only to determine their students’ eligibility for any state or federal aid.

Schools that use the PROFILE can customize this aid application in endless ways. In fact, the schools can choose from hundreds of optional questions and how they treat the answers can differ significantly. For instance, some schools consider home equity, others don’t while still others link income to home equity. The latter policy is supposed to help families who are house rich and cash poor.

What is irritating about the PROFILE is that some of its formula is secret. The College Board doesn’t feel compelled to share its entire proprietary formula.

The College Board, however, releases a lengthy publication every year that tries to anticipate many questions that parents would have about its aid formula. I would urge you to take a look at this 54-page PDF:

2015-2016 PROFILE FAQs & Glossary

What Aid Formulas Care About

Both the PROFILE and the FAFSA do care about the nonretirement assets of parents and children.

The PROFILE assesses parent assets at 5% and the FAFSA assesses them at up to 5.64%.

Students assets are treated more harshly for aid purposes. The PROFILE assesses a student’s assets at 25% and the FAFSA assesses them at 20%.

PROFILE Example

In the example below, you’ll see how the PROFILE treats parents’ assets. Nonretirement assets include checking and savings accounts, taxable investment accounts and 529 college savings plans,

In this scenario, the parents have $80,000 in nonretirement assets.

$80,000 X 5% = $4,000

In this case, the family’s eligibility for financial aid drops by $4,000. Put another way, the family’s Expected Family Contribution increases by $4,000.

I’d argue that this powerfully illustrates that it is always good to save for college.

A family is in much better shape financially for having saved $80,000 than those who haven’t. And, I should add, that just because a family who didn’t save anything might receive $4,000 in additional aid doesn’t mean they would receive that assistance in grants. It’s likely that the family would simply receive more loans.

FAFSA and Parent Assets

Now that you know something about the formulas, I want to focus on a flaw in the federal methodology. The FAFSA has traditionally allowed parents to shelter some of their taxable assets, but the amount is shrinking fast.

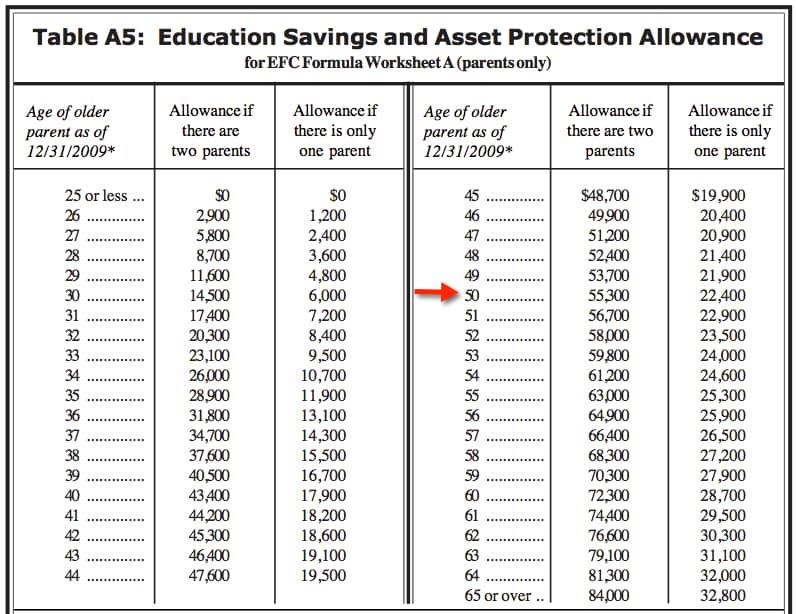

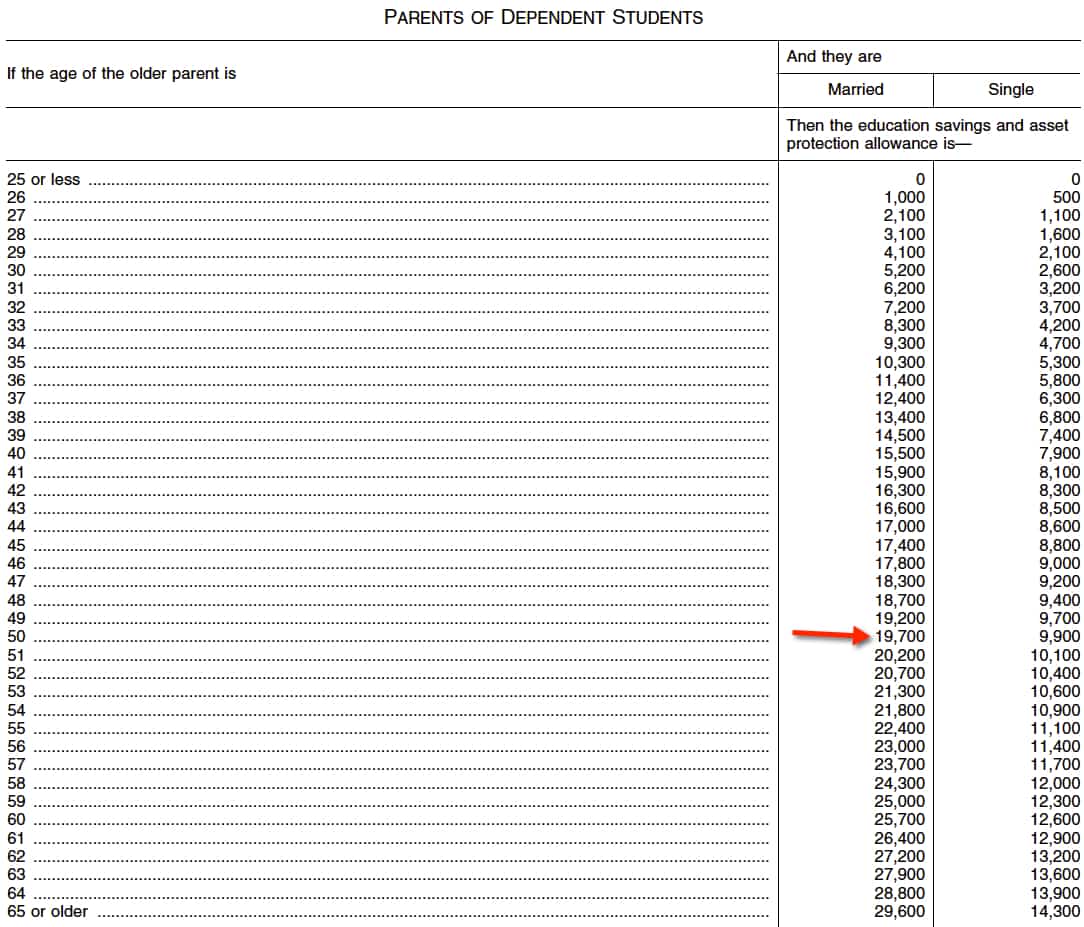

How much a family can shelter depends on a FAFSA table called the Parents’ Education Savings and Asset Protection Allowance. This table depends on the age of the oldest parent on the last day of the year. The older the parent, the more the household can shield because the parents are nearer retirement age.

As you’ll notice, a family can protect considerably more if parents are married.

Here is the current asset protection table:

Example

For the 2015-2016 school year, the FAFSA formula automatically excludes $31,800 of taxable assets from the aid calculations for a 50-year-old parent who is married.

Here is how the current calculation would impact a 50-year-old married parent with $100,000 in nonretirement assets:

$100,000 (nonretirement assets) – $31,800 (asset exclusion) = $68,200

$68,200 x 5.64% = $5,640

Aid eligibility would decline by $5,640 for this family.

A Cause for Alarm: Declining Asset Allowance

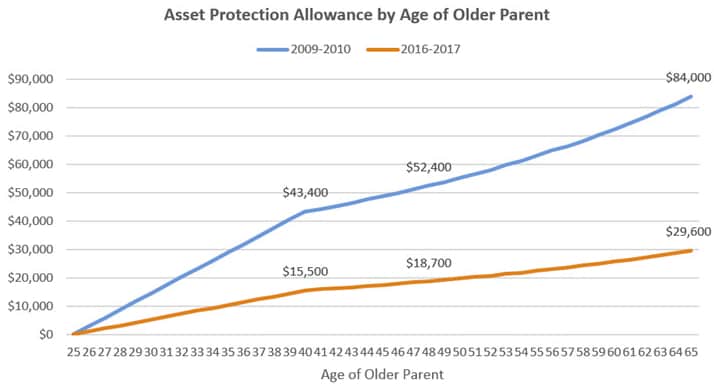

A troubling problem with this allowance is that the amount you can shelter has been steadying declining since 2009-2010 even as the cost of college has continued to climb.

You can see the decline by looking at the asset allowance chart for the 2009-2010 year below. In 2009, a 50-year-old could shelter $55,300 from the aid calculations!

And It’s Getting Worse

And It’s Getting Worse

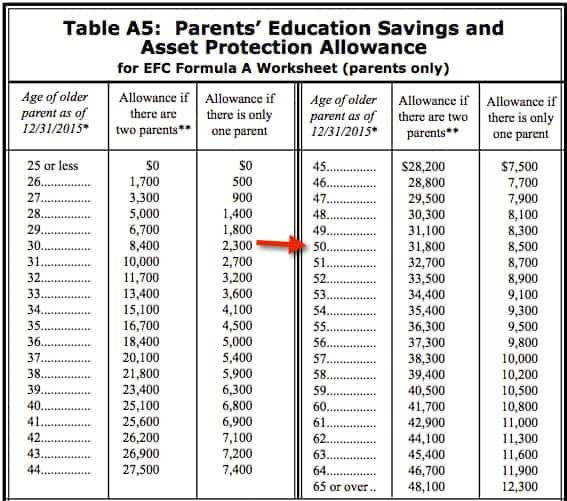

If you think that decline is alarming, just wait until you see the protection allowance scheduled for the 2016-2106 school year! The drop is stunning. The new numbers were released recently in the Federal Register:

A Bird’s Eye View of How the Asset Allowance Has Shrunk

The chart below, which illustrates how the asset allowance has shrunk dramatically since 2009, comes courtesy of Mark Kantrowitz, who is the publisher of Edvisors and a national financial aid expert.

At the rate the decline is going, Kantrowitz predicts the allowance may disappear entirely by the 2018-2019 school year!

Asset Protection Allowance and Single Parents

Asset Protection Allowance and Single Parents

This formula is even more unfair to single parents. You would assume that the formula would allow a single parent to shield at least half of what a married couple can. But this flawed federal formula is stingier than this.

In the current 2015-2016 asset protection formula, for instance, a 55-year-old married parent can shield $36,300, but a single parent of the same age can only shelter $9,500.

Months ago, I asked U.S. Department of Education why the asset allowance for single parents isn’t at least half of what married couples can shield and they couldn’t explain. They just said this is how the formula, which started decades ago, works.

Origin of the Formula

The flawed formula can actually be traced back to the Higher Education Act of 1965 that was passed by Congress and periodically renewed. You can learn more about the formula by reading Kantrowitz’s excellent post on the subject.

One way to fix the formula is to start with the 2009-2010 asset allowance table and adjust annually for inflation. Congress need to address this problem, but it is less likely to do so if parents don’t complain.

Hello Lynn,

In regards to this statement “Congress need to address this problem, but it is less likely to do so if parents don’t complain” I completely agree. I am a single parent and would like to complain about this highly unfair policy. How/where can I do that?

Or perhaps anything changed in this regard since Aug 2015?

And thank you for bringing this problem to our (single parents) attention!

Hi Lynn —

If a student has two parents who live together but are not married and file taxes separately, does the asset allocation for “two parents” still apply? Or must the parents be married and filing taxes jointly?

Thanks!

Hi Ruth,

Yes the allocation for both parents applies. The federal government requires that both parents, who are living together and not married, provide their assets and income on the FAFSA. This is a recent development.

Lynn O.

Lynn O.

Lynn,

Do you know how non-qualified retirement assets such as annuites are treated. Also how is permanent life insurance (that has a cash value) treated?

Hi Mary,

PROFILE schools will consider non-qualified annuities as assets. Some PROFILE schools will also treat cash value in a life insurance policy as an asset. FAFSA schools will not consider cash value in life insurance or any annuities as assets.

Lynn O’Shaughnessy