I am sharing an email that I got this week from a wealthy single mom, who is anticipating her college costs for her twins. I comment on her situation below and I’d love to hear from you too. If you have any advice, please share it in the comment box below.

Mom’s Email:

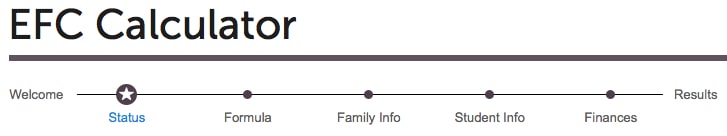

Lynn, I just finished your new book, which is so full of useful information. Thank you. I am a single mom with twins starting their junior year of high school. Both have excellent grades. I used the EFC calculator for similar colleges, one college that gives merit awards and one that does not. The merit was $6,500. My expected contribution was around $40,000 for each.

I think my income of $450,000 plus my savings and non-retirement assets are too much to expect any aid other than a modest merit award. Is that a correct assumption? I want to do some planning now before Jan. 1.

If I am going to need to pay nearly all the costs myself, then I will maximize my cash savings and, for instance, buy my next car on payments and refinance my house at a lower rate and take cash out. If, however, it would be beneficial to have less cash, I would pay down my mortgage, instead of refinancing, and pay cash for my car.

Whatever advice you could give would be greatly appreciated.

My Thoughts

1. I don’t normally run across a single mom with annual income of $450,000! The good news for this mom is that wealthy students enjoy more advantages and options than other children and the fact that her children are excellent students is even better.

2. It was smart to use an Expected Family Contribution calculator to get some idea of what your tab will be. In my book and workbook, I recommend using the College Board EFC calculator.

The EFC represents what a family would be expected to pay at a minimum for one year of school. So if a person’s EFC is $30,000 and the school costs $55,000, the student would hope to get $25,000 in aid.

Of course it often doesn’t work out that way because most schools end up gapping some of their students. Most colleges cannot provide all their students with the maximum amount of financial aid they need. Typically it’s the students who are less attractive freshman candidates, as well as low and middle-income, who receive poorer aid package.

3. The EFC can also be misleading for wealthy families. The mom mentioned that her EFC for each child is $40,000. (I suspect that if she had only one child heading to college, her EFC would be closer to $80,000.) Just because the mom’s EFC is quite high doesn’t mean she would have to pay $40,000 for each child.

Nearly all schools in this country provide merit scholarships to affluent students. It’s far easier to identify the schools that don’t offer merit scholarships to rich students than name those that do. There are probably only two or three dozen schools at most that don’t provide merit scholarships. The scholarship-free institutions are the nation’s most elite schools including the Ivy League members.

Check the top 10 institutions in US News’ prestigious national university and national liberal arts college categories and you’ll have a great idea of which schools don’t dispense merit scholarships to wealthy students. Many of these schools don’t offer merit scholarship to rich students because they can easily attract these applicants without help. If their US News rankings ever started slipping (highly unlikely because of how the methodology is rigged), I’m sure they would start dispensing them.

Meanwhile highly selective schools that offer merit scholarships to rich students tend to give out low awards because they can attract rich applicants without carrots. For example, Stanford ($4,985), Carleton College ($3,368), Bowdoin College ($1,000) and Northwestern University ($2,521) offer very modest scholarships to wealthy students.

The mom said that one school offered nothing and another offered $6,000 scholarship. (I think the mom was using net price calculators not an EFC calculator because the latter wouldn’t mention prices for individual schools). The $6,000 annual scholarship is on the low end. The average tuition discount at private universities in this country is about $14,000 a year, which comes from the College Board.

4. The mom also wants to know if it would be worthwhile to have less cash for financial aid purposes. I can’t directly answer that because I don’t know enough about her circumstances, but I can say that the biggest driver in the EFC formula is the parents’ income. If only one child was in college and her EFC was around $80,000 there would be no chance she could get her EFC low enough to qualify for financial aid.

Because her children’s EFC is $40,000 a piece it would be worthwhile to see whether factors such as her taxable assets and her home equity (in cases of PROFILE schools) would make much of a difference in her EFC. Lucky for this mom, all schools must now post net price calculators on their websites that provide a personal estimate of what a school will cost a particular family. This mom can play around with different financial scenarios to see if they impact the EFC.

In my favorite college blog post of summer, I wrote about a dad who did play with net price calculators to determine what impact his considerable home equity ($800,000) would have on his aid packages. If you missed that one, here it is:

Will Your Home Equity Hurt Financial Aid Chances: A Case Study

Lynn O’Shaughnessy is the author of newly released second edition of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price.

With her income, financial aid seems unlikely regardless of small or even significant changes in her assets. If this mom would like to save some money from full freight, looking for merit aid from less selective colleges, as you generally recommend, Lynn, seems like the way to go.

If it was me, though, I probably would feel blessed to have the ability to pay for whatever choice our family makes.

Run the net price calculator for a bunch of schools – it’s easy once you’ve done a few and can indicate trends (I’ve done 67 so far, keeping a googledocs spreadsheet that I’ve shared with my rising senior daughter).

Hi Dorothy,

That’s amazing. You’ve crunched the numbers with 67 net price calculators! I’d love to know what your experience has been with so many calculators. Would you care to share?

Lynn O’Shaughnessy

Sure! It really wasn’t THAT much work. Turns out there are really only a couple dozen basic questions and don’t vary much between calculators. In fact there are really only two main calculators I’ve encountered.

Most of the NPCs are through the College Board (or one other service). As long as we’re logged in to the College Board site, the information is automatically filled in when as we go through it the questions. For many of the others, the info shows up with Chrome autofill so I don’t retype it every time. In any case, even though I’m guessing on some of our financial information, I just try to be consistent with the information entered. I also use a pretty generous estimate of our situation: since with our income we are mostly looking for merit aid.

Then I copy the award results to the googledoc spreadsheet. The columns are: school name; geographic region; whether we found it in Colleges that Change Lives; whether it’s private; then COA; award; net price; and finally whether they used the College Board method and if they requested GPA/ SAT info. I do not include loans and work in the “award” calculation because I’m just looking at cash in hand (And out of pocket!). So whenever we look at a new college, I just add it to the list. With Googledocs it’s also really easy to sort by any one of those characteristics.

Lynn, I can send you the link to the spreadsheet privately if you’re interested and let you know our general demographic information for comparison. The trends definitely back up all the information I’ve learned from you (and some of your colleagues): smaller, lesser known, small private liberal arts colleges offer smallest net prices (with the exception of the smaller state schools).

Thanks so much for your work! I’ve given your book to friends and recommended it to many more!

I find it rather peculiar that nobody is offering suggestions. It could be that everyone is either on vacation or out at Orientation Week, or that they have no sympathy for somebody that makes $450K/yr.

I started with a long answer, and it all came back to this:

Choose the colleges that interest her child and then look at the numbers. It may be a moot point if her child gets into a great college.

At $450K/year her time is worth ~$225/hr. Yes, it is drudgery to “run the numbers”, but then again, she is spending spending ‘x hours’ to get ‘y dollars’ in merit aid. Working 10 hours to find $6,000 is a worth $600/hr in ‘homework’ time. Log in as a guest and see what comes up. To get $20,000 in aid is worth 80 hours of her time (or somebody’s) to do the leg work. There is no easy “one size fits all” way for her. I would also try different top line and bottom line numbers. AT $450K/yr, she should understand that it will take time to do the calculations, but it’s easier the second, third, fourth time, etc.

Dave — Love your observations. I also think perhaps people can’t relate to someone with that much money – or at least enough to give advice. And she’s in so much better shape than the vast majority of parents with teenagers.

Lynn O’Shaughnessy

i think part of the reason there were no responses, Lynn, is that the mom gave no info about the students except that they have “excellent grades”. Hard to make suggestions without some specifics – GPA, curriculum, test scores, interests, etc. The mom seemed to focus on her money exclusively.

The problem here is that anyone with an income of 450K is using a loan to buy a depreciating asset (a car). WHy in the world is she doing this? Also, why does she have a mortgage? If here children are now almost college age, the mortgage should already be paid off.