Should your child apply early decision to college?

This is the time of year when high school seniors aiming for more selective to elite colleges and universities must decide if they will apply early decision.

When students submit an early decision application, they promise that they will attend if the institution accepts them. A student accepted via early decision must withdraw all other college applications.

Early Decision Gamble

Unfortunately, students must make this ED commitment before they know what kind of financial aid or merit award the school might provide.

Because students are supposed to commit without this essential financial information, the ED route chiefly benefits wealthy families who can pay regardless of whether or not they are happy with the award package.

Early Decision Advantage

It’s easy to see why early decision is so popular.

Teenagers enjoy a significant admission advantage at many schools that offer early decision.

Colleges provide the admission advantage to ED applications because they want to lock in early as many incoming freshmen as they can. With so many students applying to large numbers of colleges, ED is a way for institutions to better control their admissions process.

You can discover if there is an early decision or early action advantage at a particular institution by heading to the College Board’s website.

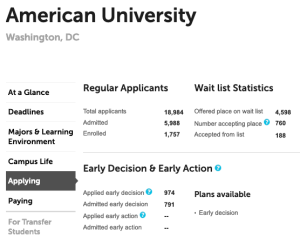

I’m using American University to illustrate what you’ll discover because I don’t know of any other school where the ED admission advantage is so massive.

Step One:

Type in the name of the institution in the College Board’s search box.

Step Two:

Click on the school’s Applying link which is located in the left-hand column.

Step 3:

At the top of the Applying page, you’ll see the acceptance statistics for regular decision, early action and early decision applicants. You’ll also see the wait list stats.

The most recent acceptance rate for regular applications at American University was 31.5%. In contrast, the ED acceptance rate was a whopping 81.2%.

You’ll have to do your own math to generate the acceptance figures.

Another Early Decision Resource

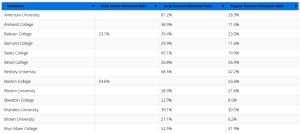

Rather than researching schools individually, you can head to College Transitions, a college consulting firm based in Georgia that provides admission advice to families across the country.

College Transitions has compiled these admission figures for you. You’ll also find many other important college statistics in the firm’s Dataverse resource section.

Here is a sampling of College Transitions ED/EA list:

![]()

Should your child apply early decision?

Every year I get emails from parents who wonder if they should risk applying ED if they are going to need financial aid or merit scholarships.

There is no one right answer to this because you need to appreciate whether you are seeking need-based aid and/or merit scholarships and how generous a specific institution is with its aid policy.

American University and Early Decision

Let’s take a look at American University. This isn’t a school that is generous with its financial aid. According to College Board statistics, only 12% of students who have demonstrated financial need get their full financial need met.

The average need-based aid award at American University is $29,118, but the tuition and room/board is $64,769. And that doesn’t count transportation, books and miscellaneous expenses.

What’s more, the $29,118 figure is what the average award was to students who ended up attending. Add in the offers to applicants who walked away and the average award would certainly be lower.

For families looking for merit scholarships, American’s average merit award is just $13,347, which is a pittance compared to the price.

Should a family go ahead and apply ED to American University when the odds of getting accepted are so high, but the price tag could also be too high?

Net Price Calculators and Early Decision

To answer the ED question for American U. or any other school, families must use the institution’s net price calculator.

For those who don’t know what a net price calculator is, here is a quick description:

A net price calculator will provide a personal estimate of what a school will cost after any grants and scholarships from the institution itself are deducted from the price tag along with any applicable state and federal grants. A good calculator will ask for information such as the following…

- Parent and student incomes and assets

- Number in college

- Parent marital status

- Home equity (most schools don’t require this)

- Size of the household.

- Student’s GPA, test scores, class rank (won’t be asked if school doesn’t provide merit aid)

The federal government mandates that schools post a net price calculator on its website, but most families unfortunately don’t even know this invaluable tool exists.

For those concerned about cost, the use of a net price calculator is essential before applying ED anywhere.

But here’s the bad news…

Unfortunately, about half of the nation’s colleges and universities use lousy calculators that are just about useless. These pathetic calculators use a free federal template that ask the users few questions.

It’s a good bet that the calculator is a poor one if it takes about a minute or less to use. Another tip-off is that the calculator won’t inquire about family’s assets and only asks for a household income range rather than requiring figures from the parents’ tax return.

Most selective schools do not use the terrible calculator offered by the federal government. One of the private institutions that relies on the faulty federal template, however, is American University’s net price calculator.

This makes applying to American U. via early decision even more of a crap shoot.

Applying Early Decision to Georgetown University

In contrast to the American U. decision, applying to elite schools with excellent financial aid doesn’t have to be so dicey. I’m using Georgetown University, which is also located in Washington DC, as an example.

For a family who has financial need, Georgetown U. says it meet 100% of demonstrated financial need for 100% of its financial aid students.

On the other hand, Georgetown, like most of the highest ranked universities, doesn’t provide any merit scholarships. So if you won’t qualify for any need-based aid, you will be required to pay full price.

Georgetown has a good calculator so you will know if this school is affordable before applying early decision. If the price is too high, look for other schools.

If a student needs financial aid, I don’t think it’s much of a risk to apply to elite schools like Georgetown that offer excellent financial aid packages. If a college has pledged to meet 100% of the demonstrated financial need of all its students, I believe it will usually be safe to apply.

Walking Away from an ED Acceptance

What if a child applies early decision and gets a lousy financial aid package?

As a practical matter, no school can force a child to attend. If the financial aid isn’t adequate you should talk to the school to seek more assistance and if that doesn’t work you can walk away.

Does applying EA have any negative impact on need-based financial aid?

Do you receive the financial aid package with the EA offer or does that come later in the Spring?

My son is wanting to apply ED to Cornell but if he was accepted his attending is subject to him also receiving the NROTC scholarship. What is the process if he is accepted but then doesn’t receive the scholarship? I do not think we would qualify for any material financial aid.

Author

Hi Julie,

There is nothing to prevent you from looking elsewhere for a school. Tell the school you can’t afford the price without the NROTC scholarship. Cornell can’t force your child to attend.

Lynn O.

Hi Lynne,

Thanks for all the insights. As you know, ED is really for the benefit of the college. A high % of the applicants pay full tuition and this favors the wealthy. As a parent, if you allow your child to apply ED, you gain a huge advantage in the acceptance rate, but lose flexibility – and you have be prepared to pay full tuition. Some schools realize the downside of ED (eg Harvard) and have stopped.

It is too bad that we have the confluence of the common app with ED. Along with the college board selling your child’s data to increase applications and rejection rates – makes for a toxic stew! Please tell me how this benefits kids!

Thanks

Ray

This is all very helpful information. The more data, the easier it is to understand the process, which is all over the place. After doing so much sleuthing for two offspring, I felt like I should go into college counseling to help other families! So, thank you for doing this. My youngest applied ED after an exhaustive search, clear understanding of merit and FA policies, and getting a pledge from VP of admissions it would not be binding if financial aid was not what was promised. It was. More so, this schools FA got better over the 4 years. But, it is challenging. Also, in some cases, such as UVM, I think Early action is very important, especially for in-state kids who assume they will get in. No longer the case. Thank you for this service (and as a college dean, I know a lot about colleges and universities, but it didn’t help with the search, per se!) Keep spreading the word! Knowledge is power.

Hi Lynn

Great read and timely as well. I Utilize college transitions all the time. I enjoy them immensely as a reliable source. Since you made mention of the net price calculator and it’s often faulty usage on some college websites. Is there a place to retrieve accurate net price numbers from all the colleges and universities? Thanks

I think that it would have been more helpful if you compared two schools which both offer ED. Georgetown offers EA and does not offer merit scholarships. In reality, depending on the academic and financial profile of a student (higher GPA/SAT scores/Extracurricular/leadership), if it’s a student with a stellar profile who needs some aid, but not 100%, they might get a combination of merit and financial aid that could compare more favorably to other colleges who only offer $ for financial aid (like Georgetown)(

I also think that it might have been more helpful to compare Apples to Apples. You mention Early Decision, yet Georgetown does not have Early Decision-only Early Action which is not binding. In all fairness, it would have been better to see two colleges that both offer the ED binding program. I also think that in colleges like American University which offer merit scholarships, if you were to use an example where you compare two students with different admission statistics (GPA and SAT scores) and eligibility for financial aid, you might see the student with the higher GPA/SAT scores who qualified for some financial aid end up with a strong package of aid and merit which might not be available for that same student at a college that doesn’t offer merit aid.

Hi Lynn,

How does Early Decision differ from Early Application? My understanding is that EA is non-binding, but it still puts you ahead of other applicants when it comes to scholarships, housing, and other opportunities at a school.

What are your thoughts?

Thanks

MIke B.

Author

Hi Mike,

Early action typically doesn’t provide as good a boost for admission and sometimes none at all. You can check the EA statistics at College Transitions to see what kind of advantage you might have going this route. And yes, EA is nonbinding which is great. If you want to apply to schools with EA, it’s a no brainer to apply early action to those schools since there is no obligation to attend.

Lynn O’Shaughnessy

Thanks!

How can apply?

Terrible post…why pick on AU? As a parent of a recent AU graduate, I find your post terribly unhelpful.

Author

Hi Rita,

Please don’t take offense. Parents need information to know how much schools are going to cost in advance and to avoid those who charge too much and provide inadequate financial aid. American U doesn’t have to provide a lot of aid because it’s located in a popular city on the East Coast. That’s just the reality.

Lynn O’Shaughnessy

Georgetown doesn’t offer Early Decision.

Georgetown doesn’t offer Early Decision.