The College Board is a favorite resource of mine when I want to get a quick read on whether a school is stingy, financially awesome, or somewhere in between.

What you’ll find on the College Board is equally relevant whether you are seeking schools that provide generous need-based aid or are hunting for schools that provide merit scholarships that are awarded without regard to a family’s finances.

In this video, I explain how you can easily use a school’s financial figures to determine what kind of merit awards or need-based packages an institution usually provides. I selected the following four schools to demonstrate what you can find on the College Board site, as well as to illustrate the different institutional priorities that schools have when deciding who gets awards:

- Washington University in St. Louis

- New York University

- University of California, Berkeley

- Rhodes College in Memphis

Below I’m providing you with a cheat sheet of what I cover in the video. Keep in mind that the prices are higher since I recorded this video.

How to Use the College Board Tool

Step One:

On the College Board’s home page, type in the name of any school to call up its profile. On the left-hand side of the school’s profile click on the Paying tab. Here is Washington University’s:

Step Two:

After clicking the paying tab, you’ll see the published costs of the school, which will often be scary but are usually meaningless. Next click on Financial Aid by the Numbers.

Step Three:

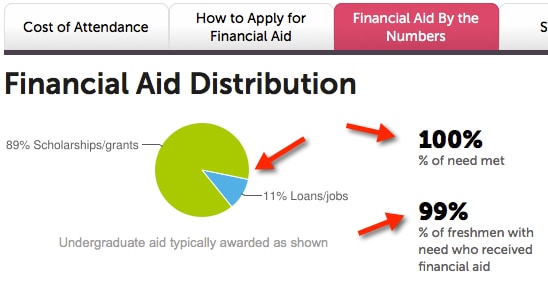

What you’ll see next is a statistic that shows what percentage of need this school typically meets. For students who require need-based aid, getting accepted into a school like Washington University that meets 100% of need is the ultimate prize.

The pie chart illustrates how the school’s typical financial aid package is broken down between free money (scholarships/grants) and loans/job. The jobs always refer to campus federal work-study positions.

Step Four:

Step Four:

Scroll down on this page to discover more financial statistics for all undergrads.

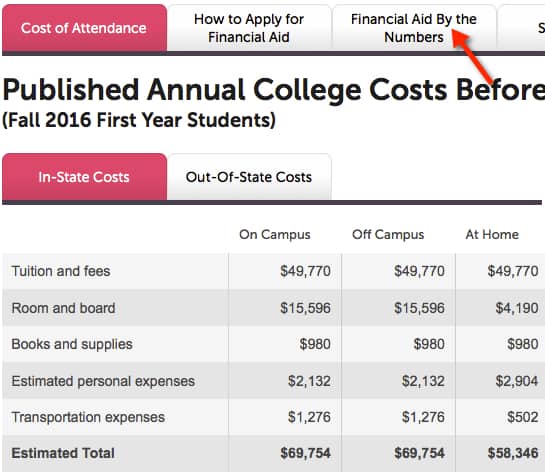

You can see above that 48% of students applied for aid at this nearly $70,000 school. (Like many elite schools, there are many rich students here who can cover the cost without any assistance.)

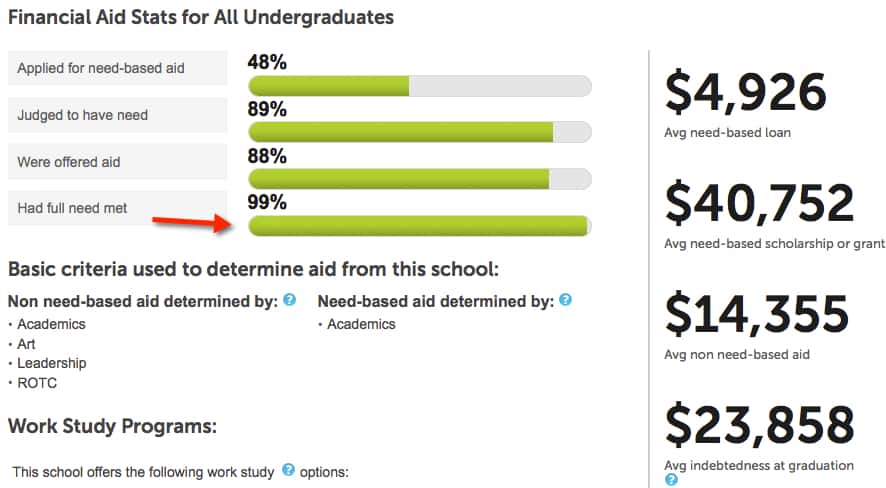

The statistic that I find most relevant is this one: Had full need met. Ninety-nine percent of students who had financial need (as determined by a financial-aid methodology) had their full need met. That’s excellent (although 100% would have been better) and only a few dozen colleges and universities can make the same claim.

On the right-hand side you will also see the value of the average need-based package. For Washington U., it’s $40,752. As for the need-based loan, you can almost always assume that the school will insert the maximum federal Direct Subsidized and Unsubsidized Loans into the package. The maximum federal Direct Loan is $5,500 for freshmen.

Merit Scholarships

For those of you who will not qualify for need-based aid, this financial aid page can also be valuable. What you need to look at is the figure for average non need-based aid. That’s higher-ed jargon for merit scholarships. In this case, the average merit award for high-income students is $14,355. While you will learn what the average merit scholarship is — if it provides one — the College Board doesn’t share how many students receive merit scholarships, which is a critical piece of information to know.

COLLEGEdata.com, however, provides this missing statistic. You will learn about how to use COLLEGEdata in the next lesson.

I am low income, high asset, due to a divorce a couple of years ago. I had been a stay at home mom for 15 years. None of my divorce settlement is in retirement accounts, so it’s all exposed on financial aid forms (my daughter is a junior, so I have not actually filled any out, but I’ve run the College Board EFC calculator). The FAFSA EFC is roughly $27000 and the IM EFC is roughly $37000.

I’m in my 50’s and am earning enough to keep us afloat month to month, but really will be depending on the divorce settlement for my retirement. Have you ever heard of a financial aid appeal requesting that some portion of assets be sheltered as retirement money even though they are not in retirement accounts? Any other ideas?

Hi Christine,

Sorry for your difficult position. It’s unfortunate that your settlement didn’t include retirement accounts. I am hoping that the father of your daughter will be contributing to her college education.

When you have low income, you may qualify for a federal simplified needs test. You would have to have an adjusted gross income of less than $50,000 to qualify. You would also have to be able to be eligible to file 1040A and 1040EZ even if you filed the 1040. With this needs test, you would not share your assets on the FAFSA and neither would your child. The PROFILE doesn’t use this means test.

Another thought…You could appeal to schools and tell them that you have no retirement accounts. Whether you would have any luck could depend on the generosity of the school, how it’s doing with freshmen deposits and how much the institution would like your daughter.

Among the schools that I would look at are your own state schools along with out-of-state universities that give excellent merit aid to students with high test scores and GPAs. I don’t know if your daughter fits that description. I’d read the lesson on state universities and merit aid. You might have some luck with liberal arts colleges that look at applicants holistically and I’d recommend if you look there that your daughter make a huge effort to connect with college admission reps, spend time on the schools website, visit if at all possible, schedule a interview etc.

Lynn O.

Hi Lynn,

Are there good tools for schools in Canada (i.e. McGill)? There is nothing on the college board/collegedata.com. Everyone seems to think that Canadian schools are more of a “bargain”…but I’m not sure if we are looking for financial aid/merit aid. Maybe if one is not eligible for financial aid and must pay full price?

Thanks!

Hi Stacey,

One resource that I’d check out is Universities Canada. Here is the link: http://www.univcan.ca/

Here is a list of tuition ranges at the Canadian schools: http://www.univcan.ca/universities/facts-and-stats/tuition-fees-by-university/

If you apply to Canadian schools, your child would not qualify for need-based aid. You would not qualify for federal or state aid and Canadian schools would not give your child need-based aid. You would qualify for federal college loans if the Canadian school is recognized by the federal government.

In general, Canadian schools will cost about as much as you would pay at many state universities as a non resident after merit aid. Keep in mind that the vast majority of state universities offer merit scholarships. The more prominent the Canadian schools, the more expensive they can be. Also the price can be more expensive for certain majors such as engineering.

Another factor is the currency difference. When the Canadian currency is down, it represents a better deal for Americans. Here is a story from earlier this year about this;

http://www.theglobeandmail.com/news/national/us-students-eye-universities-at-a-reduced-price-in-canada/article28334394/

The vast majority of Canadian schools are very large and the most popular are in urban areas – most notably McGill. One that you might want to take a look at that’s off the radar is Quest University, which is the country’s only private liberal arts college. The school, which is in British Columbia, has an awesome story. Here is a link to learn more: http://www.questu.ca/about.html

Lynn O

Lynn, could non-need based aid also include athletic scholarships (and not just merit aid)?

Hi Karen,

It’s possible for a student to receive merit aid and an athletic scholarship.

Lynn O.

Hi Lynn-

Can’t seem to play video at the top. Can you check the recording?

Thanks-

Barbra

Hi Barbra,

I am so sorry you can’t play the video. I don’t know why you wouldn’t be able to access it. I tried and it works fine. I would suggest that you try a different browser. You also might want to look at the video by going directly to YouTube to watch it. Here is the link: https://www.youtube.com/watch?v=PDw7n5SRswk

Lynn O.

Hi Lynn,

Regarding the financial aid by the numbers section on college board for state colleges and universities, do these averages only represent in-state applicants?

I know some state colleges/universities provide scholarships to students simply because they are non-state residents, and they can be quite large scholarships.

I guess the only way to find out is to do the net price calculator for each college/university where the student is a non-resident. Is this correct?

Hi Linda,

Average need-based aid figures for state schools will be irrelevant for nonresidents since they can’t expect need-based aid from these schools. I’m not saying it never happens, but you should just assume that it won’t.

The nice thing about state schools is that they are often transparent in terms of who gets merit scholarships. If you look on a school’s website or Google the term scholarships and the name of the school, you will often find out what test scores and GPA and sometimes class rank is required for various merit scholarships. Please be sure to read my lesson on state universities and merit aid in the module entitled, Targeting Schools for the Most Money, Part II.

Lynn O.