One of the frustrations of applying to college is the confusing nature of many financial aid awards.

Even when a teenager has received a puny financial aid award, schools don’t necessarily want families to know this. Some parents will look at a misleading financial aid award and think their child has won scholarships to cover much of the cost of college. What they might have actually received is an award stuffed with loans.

I blame a lot of the confusion on the jargon-laced terminology and unhelpful formatting that many college financial aid offices use. Why do plenty of financial aid offices insist on cranking out misleading financial aid awards? Gosh, could it be that some of these letters are marketing tools meant to obscure the real price of colleges?

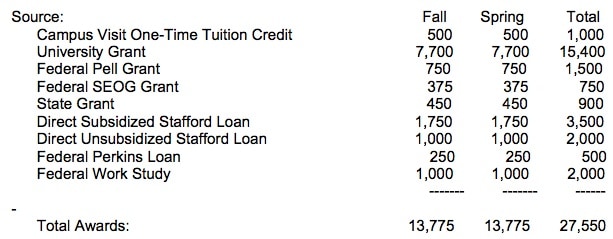

Here is an example of a misleading award. You might assume that the student is receiving $27,550 for school, but it’s actually $19,500 if you subtract the loans and the work study. And it might actually be $18,500 if that campus visit credit is truly a one-time deal. The financial aid award also doesn’t disclose what the actual cost of the college is, which is obviously a crucial piece of information.

Poor Financial Aid Award Letter

A Better Financial Aid Award

There is no reason why colleges can’t do better. That’s why it’s good news that the federal Consumer Financial Protection Bureau and the U.S. Department of Education has released its own prototype of a model financial aid award. You can see it below:

Financial Aid Award Prototype

Here’s what I like about this simple model award letter:

- At the top, it provides the costs of this school.

- It clearly separates the grants and scholarships from the loans.

- It shares what federal loans (the best kind) that the student would qualify for.

- It includes what private loans would be necessary if families can’t cover the tab after federal student loans.

- Super important: it reveals what the loan tab would be upon graduation, as well as the estimated monthly payments.

What Do You Think?

The bureau is seeking input from families on this prototype. Here is where you can express your opinion about the model financial aid award letter. Regardless of what the final award proposal looks like, colleges would not be obligated to use the template and I think that would be a shame. Congress cshould pass a law that forces all schools to use a standardized letter.

Families want and deserve a standardized financial aid form. In a survey for Fastweb, a scholarship search engine, 84% of parents said they wanted standardized aid letters.

What do you think?

Lynn O’Shaughnessy is the author of The College Solution, an Amazon bestseller, and the workbook, Shrinking the Cost of College: Great Ways to Cut the Cost of a Bachelor’s Degree. Follow me on Twitter and Facebook.

More on The College Solution:

Deciphering a Financial Aid Package

Deciphering a Financial Aid Package Part 2

Where Are the Freshmen Coming From?

First of all, I just discovered your blog and I’m really enjoying it.

This financial aid award prototype is perfect! It frustrates me to no end when they list loans right along with scholarships, as if they’re the same thing at all.

Thanks for making us aware of this.

Hi Julie,

Glad you discovered my blog. Please spread the word about it. Thanks for visiting.

Lynn O’Shaughnessy

I’m with Denise. I think students have no concept of how much of a dent student loans can make in a post-graduate budget. I know I didn’t, but I only had around $7,000 to pay back.

We will be finding out within months what kind of a job colleges will do in award letters. Yippee… The proposed format would be very, very nice.

Denise — I hope the standardized award letter will be required by Congress, but how often do our politicians do the right thing? Hardly ever.

Lynn O’Shaughnessy

Hi Lynn,

This template is excellent and seems very valuable (I will be starting the process next year).

I like that it includes the estimated monthly payments for loans after graduation. Your eyes can sort of gloss over the big numbers, but everyone can relate to the reality of monthly payments.

I think most students would balk at seeing that they have to pay back $700 per month for a relatively inexpensive private college. Better to see it and accept it before signing up.

Denise — I totally agree with you. I think what would really going to stick out would be those monthly payments. That’s going to be the deal breaker for many. Better to know this up front than after graduating!

Lynn O’Shaughnessy