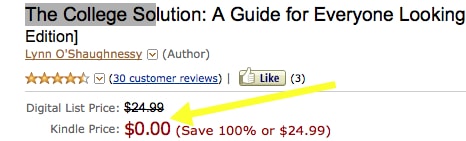

If you’ve got a Kindle or a Nook and you haven’t bought a copy of the second edition of my book, The College Solution yet, you are in luck! The publisher is temporarily giving away the electronic version of my new book for free!

I don’t know how long this price will last, but I’d jump on it. If it’s any consolation for those of you who don’t have a Kindle or Nook, the book is currently being sold online at a 39% discount.

Admission Secrets Revealed

I’m sharing a piece today about the current college admission climate that was written by Dean P. Skarlis, who is president of The College Advisor of New York in Albany.The Washington Post originally carried the piece and he agreed that I could share it with my readers.

According to the The Chronicle of Higher Education, there now are 100 colleges which cost more than $50,000 per year, including the first public university, the University of California at Berkeley.

What would shock unassuming parents even more than exorbitant tuition are some of college admissions’ dirty little secrets. I believe shock therapy is necessary, given the size of the investment parents will make in paying as much as a quarter of a million dollars for four years at many of these popular schools. They need to be alerted so they can separate valuable information from propaganda.

Beware of Conventional Wisdom

A piece of conventional wisdom imparted by colleges that I routinely recommend consumers ignore is to “let Johnny first select the school and then mom and dad can figure out how to pay for it.” The logic here is that these two parts of the college selection process are distinct and mutually exclusive. This couldn’t be further from the truth.

Over the past 20 years, colleges have changed dramatically. The majority of schools now have significant agendas, and are less concerned about making the best match. Instead, they seek high quality students, diversity, and as many “full pays” as possible. The admissions and financial aid processes have become irreversibly intertwined and students whose parents can “write the check” stand a markedly better chance of getting admitted, all other factors being equal.

The Story Behind Need-Based Aid

Another favorite tip counselors love to give is to search for colleges that offer “need-based” financial aid. Families often hear this term at college fairs, and read about it in the media. What need-based aid means is that an institution promises a prospective student a financial aid package that covers ENTIRELY what the financial aid formula says the family can afford. This aid comes in the form of grants, loans and work-study awards.

But schools use different aid formulas to assess families’ ability to pay, and the reality is that need-blind admissions is available at roughly two dozen of the most elite institutions in the U.S. that can afford to offer full aid. For the 99 percent of students who can never get admitted to these highly selective schools, this policy doesn’t apply. Yet it lures people into believing that the admission decision and the award package are awarded SEPARATELY. This may have been true in the 1980s, but it certainly is not the case now.

Colleges Are Businesses

A friend of mine who is an admissions dean at a well-known research institution laments how much college admissions has changed.

She says: “Today, it’s all about ‘net tuition revenue,’” or hitting a revenue target that a school projects it needs. A client recently informed me that when they told an admissions representative that they expected to be paying the full price, given their income, the admissions person said the institution was “need-aware,” meaning they would look favorably on their high income in the admissions process. Translation: The school wanted this client’s child and was willing to admit the student. By the way, this student was a marginal candidate applying to a selective college. So much for egalitarian idealism.

Using both need-based financial aid and merit scholarships, the dirty little secret is that schools are leveraging “the best” students – this term is relative to every college and every student. Colleges throw more money at the kids they want the most—athletes, strong academicians, minority students, and students gifted in music or other talent that will shed more glory on the institution.

Uncovering Hidden College Gems

If parents want to pay less, they need to understand which colleges want their child most and why. They must consider cost early in the process, and be realistic in considering schools that are not among the top brands. There are hundreds of “hidden gems” across the country, and families who approach the process strategically stand a better chance of finding them.

Finding great schools at a lower price can be a mind-boggling process for busy, working parents, but they have to understand that they are their own best advocates.

Colleges have the financial aid shell game down to a science. Consumers are mostly oblivious to the fact that the admissions and aid processes are not simple and noble. Given the absurdly expensive cost of many popular schools, families should wake up to the fact that they must consider cost early in the college selection process.

Lynn O’Shaughnessy is the author of the second edition of The College Solution.

Read More at The College Solution:

The Best Colleges You’ve Never Heard Of

My kid was given a loan in her first year of doctorate. 2nd year, right now, they’re giving her a hard time due to a Macy’s credit card payment history when she was 19. She paid it off a year ago. They’re demanding a copy of Macy’s bill which was 5 years ago…she no longer has it. How can they do this, even the school financial counsellor is of no help at all.

Julie,

That is the same situation our family is in. The data can be found, but it takes some work and must be done on a school to school basis (at least I’ve yet to find aggregated data on this). Google “Common Data Set” with the school your interested in. All schools are no required to file this information with the government. All financial aid data is in the H section. Non-need based aid is in the H2A lines, needs based H2. Stanford for example awarded 821 need based grants to incoming Freshmen last year at an average of just under $40K per student. Contrast that to 87 non-need based grants at an average of just under $5K. Many “top” schools unfortunately offer little or NO non-need based awards. Personally, I wish there was a centralized source for this information. Good luck!

Mike

Julie,

That is the same situation our family is in. The data can be found, but it takes some work and must be done on a school to school basis (at least I’ve yet to find aggregated data on this). Google “Common Data Set” with the school your interested in. All schools are no required to file this information with the government. All financial aid data is in the H section. Non-need based aid is in the H2A lines, needs based H2. Stanford for example awarded 821 need based grants to incoming Freshmen last year at an average of just under $40K per student. Contrast that to 87 non-need based grants at an average of just under $5K. Many “top” schools unfortunately offer little or NO non-need based awards. Personally, I wish there was a centralized source for this information. Good luck!

Mike

Oops, typo, the school “you’re” interested in. 😉

Thanks Mike, for sharing that info about the Common Data Set. The Common Data Set is not used by the federal government, but it is used by collegiate publishers like Petersons, US News and the College Board.

Lynn O’Shaughnessy

So if the fafsa says you are not needy (even though you know it would be very unwise to spend so much on an undergrad degree) then if your kid can get into a school where need-blind admissions is available at the most elite institutions that can afford to offer full aid– Would you would simply be asked to pay full price or close to it?

For example when Stanford says it meets 100% need and 92% is scholarship that sounds promising but this applies only to those that are needy and smart? Or does this too vary by school?

So if the fafsa says you are not needy (even though you know it would be very unwise to spend so much on an undergrad degree) then if your kid can get into a school where need-blind admissions is available at the most elite institutions that can afford to offer full aid– Would you would simply be asked to pay full price or close to it?

For example when Stanford says it meets 100% need and 92% is scholarship that sounds promising but this applies only to those that are needy and smart? Or does this too vary by school?

Thanks for the free book. I look forward to reading it as much as your blog.

You are very welcome SB. If you like the book, I’d love to get a review on Amazon. 🙂

Lynn O’Shaughnessy

Thanks for the free book. I look forward to reading it as much as your blog.

I completely disagree with the point about financial aid and the admissions process being completely intertwined. I am the Director of Admissions of the Music Department at Virginia Commonwealth University. Our admissions process is NOT based upon whether or not a student can pay full price, even if all other factors are equal. I think it is unfair and misleading to prospective parents to make a blanket assumption about all universities based upon the practices of a few.

Hi Amy,

Yes, the favoritism shown to rich students is more a private school phenomenon. Here is a great example of how it works: http://www.nytimes.com/2009/06/10/business/economy/10reed.html/?pagewanted=all

Lynn O’Shaughnessy

Amy,

It is definitely a private school phenomenon, however, as states continue to cut appropriations to public colleges, many publics are beginning to emply similar tactics.