I have been writing college blog posts recently about teenagers who have arguably been applying to the wrong colleges. (Scroll to the bottom to see my three previous posts.)

All my posts have involved families who required financial aid, but today I’m sharing the plight of a father who is too wealthy to receive need-based help.

Anxious Dad’s Email

Here is the email that I received from the father, who is a financial adviser:

I have a high school senior who applied to Johns Hopkins University and was accepted. She is also going to play field hockey there. Being a typical “rose colored” glasses person, I figured we’d get some financial assistance. I filled out the CSS/Financial Aid PROFILE. The package came back and there was ZERO assistance on there.

I thought the field hockey thing would provide her some backing and consideration but I was wrong. Additionally I’m usually very good at getting a straight answer from people and for some reason I didn’t from our liaison at JHU. I can’t believe JHU considers us rich! Does anyone back there know how expensive it is to live and raise a family in Southern California?

Needless to say, I’m a little discouraged and concerned since it’s such an expensive school. I know JHU has resources. I’m very surprised we did not get any assistance. I was wondering what you recommend.

My Response

I am sorry that your daughter didn’t receive any money from Johns Hopkins, but this is a university that almost never gives money to rich students. If you have a high Expected Family Contribution, which was generated by the PROFILE, your daughter would have had a slim to zero chance of getting any money.

Finding the Answer in the Common Data Set

Okay, so how did I know that Johns Hopkins rarely gives scholarships to well-off students? I looked at John Hopkins’ Common Data Set, which is a valuable document that many schools complete yearly that contains a great deal of information about such things as the institution’s need-based aid, merit awards, acceptance figures, academic profile of freshmen and much more.

Section H of any school’s Common Data Set contains the information on the number of students who apply for financial aid, the number who receive aid and what the typical financial aid package is. In the same section, the Common Data Set also shares whether the school gives merit awards to wealthy students.

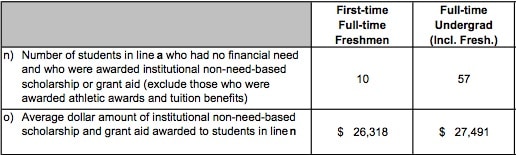

Only a handful of wealthy students received money from Johns Hopkins, which reserves its financial awards to students with demonstrated financial need. Here is the pertinent section of Johns Hopkins’ Common Data Set:

In the 2010-11 school year (latest available), just 10 freshmen received merit scholarships, which were worth an average of $26,318. To give you a frame of reference, there were 1,241 students in the university’s freshmen class and 551 freshmen received need-based grants. The average need-based grant was $30,791. Doing the math, you can see that the majority of students — 680 – paid full price. Like a lot of highly prestigious East Coast schools, Johns Hopkins is crawling with rich kids, whose parents are footing the entire bill.

Almost all schools in this country award merit scholarships to rich students, but a few highly prestigious ones don’t give awards to these teenagers or they dispense just a few token scholarships. Johns Hopkins belongs in this category. Schools like all the Ivies and the very top liberal arts colleges don’t have to hand out merit money to wealthy teenagers because they institutions enjoy such high perches in US News & World Report’s college rankings that rich students flock to them without any carrots.

What About the Other Schools?

In responding to the dad’s email I suggested that there could be other schools on his daughter’s list that do give wealthy students merit money. Unfortunately, the two additional schools that he mentioned — MIT and Tufts University — are in the same category at Johns Hopkins.

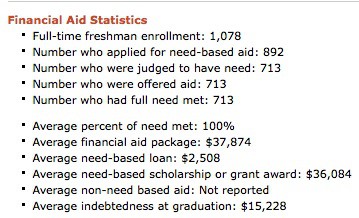

Another way that you can research a school’s financial aid practices is to look at the institution’s profile on the College Board’s website. Click on the school’s Cost and Financial Aid link. Here is the link to MIT. You’ll find the pertinent statistic for the dad on the second-to-last line that says average non-need-based aid. In MIT’s case it says not reported. Whenever you see not reported that simply means no merit awards for rich kids.

When I checked Tufts University’s financial aid stats on the College Board, I saw that the average non-need based aid was $500. That’s essentially nothing. Unfortunately, I couldn’t find Tufts’ Common Data Set, which is irritating, but some schools don’t release it.

Bottom Line:

It’s always important to research the financial aid practices of schools before applying. Don’t make any assumptions.

Here are more posts on applying to the wrong schools when money is an issue:

Applying to the Wrong Universities

Catholic Universities and Yet Another Botched College List

ynn O’Shaughnessy is the author of The College Solution, an Amazon bestseller, and a financial aid workbook, Shrinking the Cost of College: Great Ways to Cut the Price of a Bachelor’s Degree.

Hi Lynn. This is good advice, but there is a far better source and easier way to seek this data than searching out CDS, which, as you point out, are not always available.

The IPEDS site is a federal site to which colleges and universities are required to report each year…lots of data on all sorts of things, many of which won’t make a lot of sense to a layman.

However, I created to visualizations to show how you can use it: The first is an admissions results dashboard which is interactive:

http://public.tableausoftware.com/views/CollegeandUniversityDatafromIPEDS2010/AdmissionDashboard

And the second is a scatter gram, showing the relationship between institutional wealth (x-axis) poor students (y-axis) and admit rate (color of bubble):

http://public.tableausoftware.com/views/CollegeandUniversityDatafromIPEDS2010/Wealthvs_Enrollment

Hi John,

Thanks for sharing that really cool tool. When I finish with my book revision, I’m going to try to figure out how to use it. It might be beyond my ability.

As for IPEDS, I obviously agree that it’s a valuable resource, but I had devoted a post to it not long ago.

Lynn O’Shaughnessy

I thought Stafford loans are included when the schools report the amount of aid they give. Aren’t practically all students qualified to take out unsubsidized Stafford loans?

Lynn, this is an extremely helpful post. The way you inserted a section from the Common Data Set from JHU was a great explanation. When I entered “[my son’s] College Common Data Set” into Google, I came up with the exact format that you highlighted, and was able to scroll to the same section (section H, letters n and o) so that I could compare statistics.

I tried some other schools and had less luck with finding the information. I’d love know if there is a website that provides a one-stop-shop for Common Data Sets of colleges and universities.

HI Emily,

Unfortunately, there is not a central spot for Common Data sets. One way to uncover hard-to-find Common Data Sets is to Google the name of the school with the term ” Institutional Research.” Even if that doesn’t work, you will often find interesting information at the online home of a school’s Institutional Research section.

Lynn O’Shaughnessy

Regarding Janet’s question about finding more affordable schools, and narrowing down the list … I found the collegedata.com “Match by preferences” feature (which you once recommended) was a great way to start the process. Once you have a list of schools in your ballpark, it’s easy to dig deeper and eliminate the ones that aren’t good fits — financial or otherwise — and add others.

With a little work, I now have a spreadsheet of about 20 schools that are pretty good financial and academic fits and by the time my son takes over the process next year as a senior (he’s contributed some names and gave input), he can cut it down by more than half and I’ll know that almost any of them will work for our family.

Without these websites, and Lynn’s blog/book resources, I would have been lost.

Thanks Denise. That’s a great way to get started by using a college search engine. In addition to COLLEGEdata, the College Board and the federal College navigators have them too.

And thanks for the kind words!

Lynn O’Shaughnessy

Lynn,

As you indicate, many elite schools give very little merit aid, but instead award most of their aid based on financial need. However, merit aid at these schools is based on just that – a student’s merit. It is not doled out to “rich kids”, but instead offered to high achieving students that have worked hard and have outstanding grades, test scores, EC’s, etc. For many students who come from families in the “donut hole” for financial aid – often middle class families between $100K-$150K in income, this may be their only hope for attending some of these schools. They come from families that are too “rich” to get meaningful financial aid and too “poor” to afford the sticker price. When you look at the common data set, collegeboard.com, college navigator and see what a school’s “generosity” in awarding merit-based aid, it’s aid that is based on merit alone – not a result of the school awarding money on account of the student’s (or famliy) wealth. I’m a bit puzzled as to why you classify this aid as “money for rich kids”, when wealth is in no way a factor that the school’s are using to award this aid. Even though it may be the case that students from wealthier families might enjoy success in getting this aid, wealth is in no way a determining factor. In short, correlation does not imply causation.

I really enjoy your blogs as they have provided a wealth of information for me and my family for several years. However, I’ve often found it to be a little off-putting when you refer to students that come from families that don’t qualify for financial aid as “rich kids”. First of all, it’s mostly their parents income that usually is the determining factor in eligibility for aid – not the kid’s wealth. Secondly, the tone of labeling a student as a “rich kid” when they don’t qualify for aid comes off as a bit insulting, IMHO.

I offer this comment as just the perspective of a loyal reader who enjoys your blog – so please take it in the manner intended. In case you hadn’t heard this constructive criticism before, I just thought it might give you a perspective of how this type of “labeling” can come across to some.

Thank you again for all of the information and insight you provide on these very complicated and confusing topics.

For what it’s worth, it helps to start researching early. I’ve been frank with my daughter and we’ve eliminated some schools that she had some interest in due to the fact that they don’t give non need-based merit aid. Making it clear that our family can afford only so much per year helps the process with her. I will probably need to start earlier with my second daughter because she wants to play Field Hockey in college. I’ll keep in mind not to have her apply to JHU….

Patty — Starting early is an excellent idea and have a talk before the search begins is crucial. And, of course, you need to know how to evaluate the generosity of colleges and universities!

Lynn O’Shaughnessy

I feel bad when I read posts like this. Although Johns Hopkins does indeed have a women’s field hockey team, it is Division 3 – which means it does not give ANY athletic scholarships for that sport. With this knowledge plus what Lynn posted about Hopkins’ need-based patterns, this family COULD have known before the daughter applied that she would receive no aid if she got in. How very unfortunate that they did not have this information.

Avoiding “mismatch” schools is great in theory, but once your teen picks a bad school, how to do you find the next-best school that is affordable? Is there a college guide with lists like the “kids who picked this school might also like….”

Avoiding “mismatch” schools is great in theory, but once your teen picks a bad school, how to do you find the next-best school that is affordable? Is there a college guide with lists like the “kids who picked this school might also like….”

Hi Janet,

The problem with suggesting different schools is that one child’s mismatched school will be another’s perfect fit. That’s because whether a school will be a financial fit will depend on a family’s ability to pay based on their Expected Family Contribution. One way to narrow the list is to decide whether a child wants to attend a college or university. Unfortunately, most families don’t know the difference. This a a topic that I’ve talked a lot about on my blog.

Lynn O’Shaughnessy