Many parents worry that their college savings accounts will kill their chances for financial aid.

If that’s what you’re stressing about, here’s my advice: take a deep breath! Most families who save for college are not hurt in student financial aid considerations.

Why Your Savings Won’t Hurt Financial Aid Chances

Here are the two biggest reasons why saving money often won’t jeopardize your financial aid chances:

1. Colleges don’t care how much you saved for retirement.

The Free Application for Federal Student Aid (FAFSA), which anyone applying for financial aid will complete, doesn’t even inquire about retirement accounts. Private colleges that use the CSS/Financial Aid PROFILE, will inquire about a family’s retirement accounts, but they won’t penalize parents for these assets.

2. Parents can also shelter plenty of money outside of retirement accounts.

It might not seem like it, but colleges don’t want to strip you of all of your available cash. The financial aid formulas will also let you shield a big chunk of your non-retirement money through an asset protection allowance.

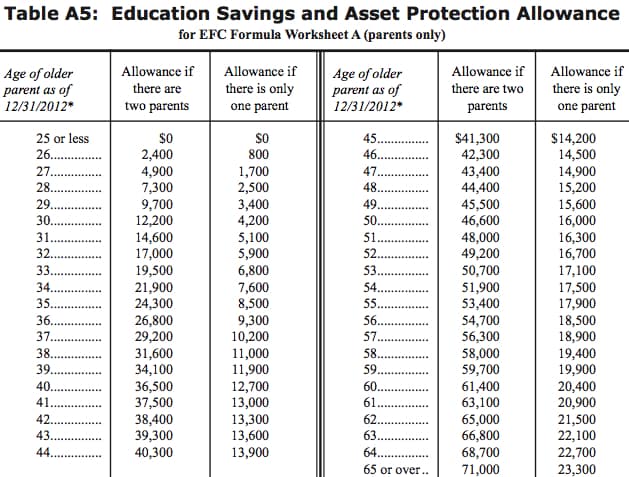

As you can see from the federal chart below, how much you can shield from the FAFSA formula depends on the age of the oldest parent. The closer the parent is to retirement age, the greater the amount he/she can shield from the financial aid formula.

Let’s say the oldest parent is 53. The family would be able to shield $50,700 in 529 savings plan money, as well as any other cash laying around in taxable accounts such as savings, checking and brokerage accounts. In a two-parent household, a 60-year-old parent could shelter $61,400 from financial aid calculations.

The amount a mom or dad could shelter in a one-parent household is significantly less. A 53-year-old single parent, for instance, could shelter just $17,500.

Asset Allowance Illustration

Using an example should make it easier to see how this allowance would work. Let’s assume that a family has $80,000 in non-retirement assets, including $25,000 in a 529 savings plan, and the oldest parent is 53.

The family would get to shield $50,700 from the FAFSA formula, which would leave $29,300 unprotected. In calculating the family’s financial need, the FAFSA methodology wouldn’t expect the parents to sink all of that money into college. Consequently, the $29,300 in assets would be assessed at a parental rate of 5.46%. When you do the math, the child’s eligibility for need-based aid would only drop by $1,652 even though the family had $80,000 in the bank.

Knowing this, would you rather be a family who saved nothing for college or the family who has $80,000 in the bank? Obviously, it’s always better to save money, whether it’s for college or retirement. Do so and you’ll enjoy more options.

Lynn O’Shaughnessy is the author of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price.

Lynn O’Shaughnessy is the author of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price.

Lynn, I am loving your book, full of good info & resources. Also, article above is great. Question: Would you elaborate on parents with higher income (below $200k or below the famous $250k), taxable accounts or money. In general, I gather that if the parents have a bank account -safety net for living expenses & mortgage, etc.- it can hurt the financial aid received by the student? These are still not rich families and can not afford a $50k/year education. Would you have an article on this subject and higher-ed financial help? Thank you!

I just filled out the fafsa and their was nothing about the Asset Protection Allowance. Is that something that they will calculate or was I just supposed to know it?

Hi Kathy,

The Asset Protection Allowance is built into the FAFSA methodology. You don’t have to worry about applying this yourself.

Lynn O’Shaughnessy

Can you explain the rationale for allowing a one-parent family to save so much less than a two-parent family? I am a widow, age 55, and have a little money for each of my kids saved (left from life insurance money.) If we were a two parent family, I’d be fine, but as a one-parent family I appear to be seriously penalized. This doesn’t make sense to me — and is there anything I can do about it? Thanks!

The calculators don’t seem to be working like that for me. Every time I fill out a net price calculator (or the CSS calculator) the EFC is far more than 6% of our savings and 20% (or 25%) of UTMA assets – and that is WITHOUT considering the shielding amount. Is the percentage deemed available scaled so it is 6% for x to y and much higher percnetage for y to z? We have money in UTMA accounts for both our children. Do they consider that both are available for the one child? If we move the money in the UTMA to a 529 we’d have to liquidate it first wouldn’t we? I’d have to figure out the tax implications there…

The only way I can make the numbers add up to that 6% is if the percentage they want from the annual income is well over 25%. If I take the shielding into account, that percentage is even higher.

Thanks for the helpful article Lynn! Do you have any advice for parents whose students have a lot of money in their own bank account?

Hi Monica,

Students’ assets get assessed at 20% (FAFSA) and 25% (CSS/Financial Aid PROFILE). If money is in custodial accounts for the students (UGMA/UTMA), it can be moved to a custodial 529 account and then the assets will be assessed at the parent rate which is 5.64%.

You can use schools’ net price calculators to determine if a student’s assets will impact aid. Usually it doesn’t.

Lynn O’Shaughnessy

Thanks Lynn! I get emailed this question a lot and I had seen the number 30% for student accounts. I will pass along your advice. 🙂