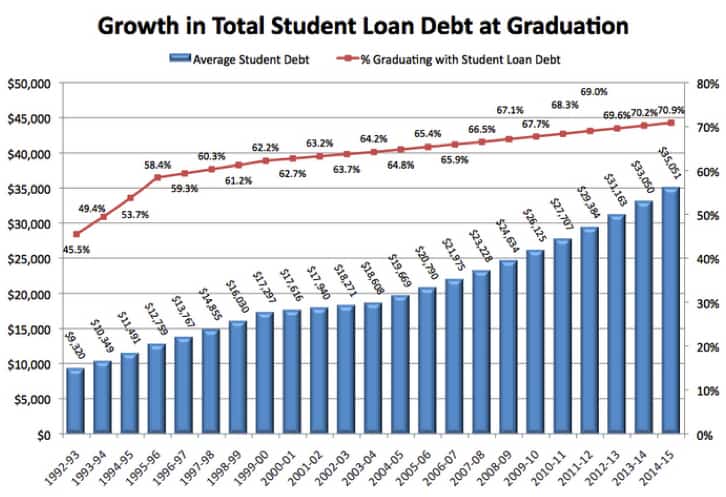

As recently as the early 1990s, most students did not take out college loans. Today nearly 72% of students borrow to pay for college due to the runaway cost of college.

The typical student borrower is leaving school with debt of roughly $35,000. Federal college loan debt exceeds credit-card debt.

Is $35,000 a reasonable amount of student debt?

Here is a chart created by Mark Kantrowitz, the founder of FinAid.org, a popular financial aid site, which shows the steady increase in student debt and the percentage of undergraduates who must borrow to finance a college education.

Is $35,000 a reasonable amount of student debt?

Is $35,000 a reasonable amount of student debt?

It depends on what type of student loans an undergraduate selects. The level of debt will be less risky and more manageable if the student only borrows via federal student loans. For most students that will mean borrowing with federal Direct Subsidized Loans and Direct Unsubsidized Loans.

Federal Student Loans

Here is why these direct federal loans are superior:

- Students regardless of their income qualify for a direct federal loan if they are enrolled at least half time and complete the FAFSA.

- Students receive the same rates regardless of credit scores.

- The loans offer student repayment plans based on a grad’s current salary.

- The loans offer a public service student loan forgiveness program.

The federal Direct Subsidized and Unsubsidized Loans are designed strictly for students. Borrowers must begin repaying these loans shortly after graduating or leaving college.

Subsidized Vs. Unsubsidized Loans

The interest rate on both the subsidized and the unsubsidized federal loans for the 2018-2019school year is 4.45%. The interest rates are adjusted annually and linked to the 10-year U.S. Treasury note. The interest rates for federal loans changes on July 1 each year.

The best loan to get is the Direct Subsidized Loan. Students who qualify for this one don’t have to pay the interest that accrues while they are enrolled in college. The federal government pays this interest. In contrast, borrowers through the unsubsidized loan are responsible for covering the interest that accrues while in college.

Qualifying for a Direct Subsidized Loan

Your college will tell you if your child qualifies for the subsidized loan. Look at the financial aid package that your teenager receives to see what the breakdown is between subsidized versus unsubsidized loans.

A federal formula is used to determine if a student, based on a family’s finances, is eligible for the better-subsidized deal. The majority of subsidized federal loans are awarded to students whose family’s adjusted gross income is less than $50,000.

You can see both kinds of direct loans in your package.

Federal Loan Borrowing Limits

Below is a federal chart that outlines how much students can borrow. The left-hand column shows the maximum amount that traditional (i.e. dependent) college students can borrow.

The other column shows how much independent students, as well as dependent students whose parents were denied a federal PLUS Loan, can borrow. (To learn more about independent students, see the lesson entitled, When a Child is an Independent Student.) Undergraduates whose parents could not obtain the PLUS Loan can borrow up to $57,500.

If a student takes the traditional four years to graduate from college, the maximum he/she can borrow will be $27,000. If the student needs longer to graduate with a bachelor’s degree he/she can only borrow an additional $4,000.

When should I apply for my federal student loan?

The new year for federal student loans starts July 1. So if your child will begin college in the fall of 2018 you would apply sometime after July 1, 2017.

Another Federal Option: Perkins Loan

The second type of federal option for students is the Perkins Loan. Students who are eligible for the Perkins have what the federal government terms as exceptional financial need.

The interest rate for the Perkins is 5%. With this loan, the student’s institution is the lender and borrowers make payments to their school or the institution’s loan servicer. If the money is available, the most a student is eligible to borrow is $5,500 a year.

Whether your child will qualify for the Perkins will depend, in part, on where he or she attends school. Because of the way the Perkin was established, not all schools can participate in the program and institutions that have access to more funds tend to be elite, private institutions.

Once a student has graduated, left school or dropped below half-time status, he or she has a nine-month grace period before Perkins payments must start.

Bottom Line:

Students should turn to the federal direct loans first when borrowing for college. Students should not consider borrowing through private loans unless their federal student loans are maxed out.