The majority of families end up borrowing for college. But when parents and teenagers talk about how they are going to divide up that responsibility, they rarely possess a good idea of what this debt burden is going to mean for them when the bills come due.

That’s why I’m recommending a tool from SimpleTuition, an aggregator of private student loans, that allows families to anticipate what the borrowing costs will be in the future for the student and the parents. The tool is called the College Cost Adjuster. You have to register on the site to use it, but I think it’s worth it.

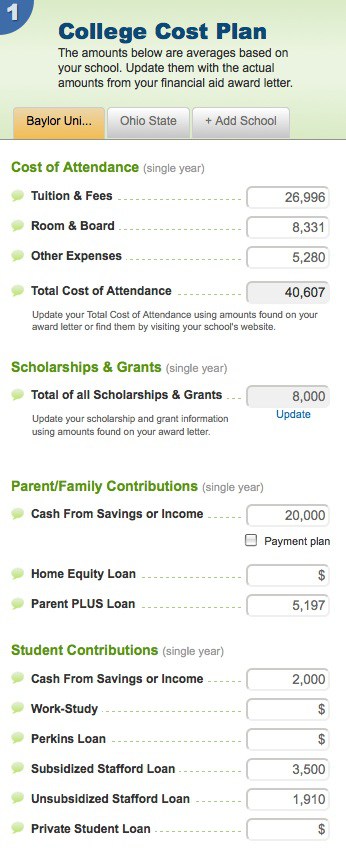

To use the College Cost Adjuster, simply type in the name of a university and SimpleTuition will automatically fill in the average cost of attendance of the institution. You will see a variety of ways to pay for the school listed including savings, scholarships, parent loans, home equity loan, work-study, private student loans and federal student loans.

What I really like is the tool’s monthly payment adjuster. You can manipulate the bar so that it will show you how much the monthly payments will be for the parents and the child by adjusting their financial responsibility. Baylor University is the example that I’m showing. The only figure I added manually was a hypothetical $8,000 scholarship.

Here’s what I saw on the screen:

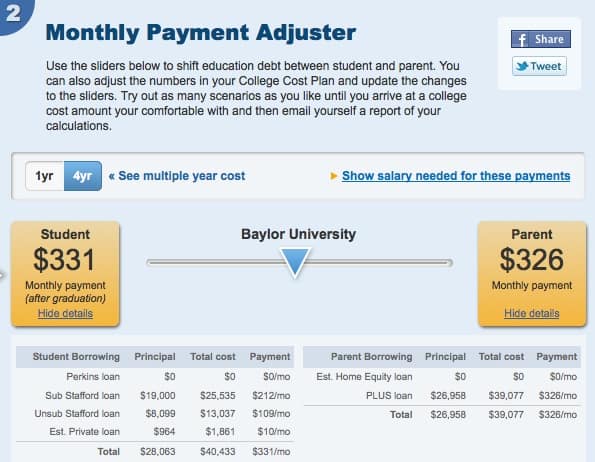

The next screen is the most valuable one because it allows you to move a slider bar to adjust what percentage of the debt burden will be assumed by the parents and the child. When you move the bar you can see the consequences of the change of the debt distribution and the sources of college funds will automatically adjust in real-time. Students can also view an estimate of the salary they will need to make to meet the expected payments for all student loans, which can be very sobering.

To see what kind of costs you face in the future you can use a one-year debt figure or a four-year figure. In the example, I used the four-year figure because it’s the realistic one.

In this example, I adjusted the slider so the monthly payments of the student and parents would be nearly identical.

Bottom Line:

Using the College Cost Adjuster can lead to better financial decisions. And sometimes the best decision will be forgetting about a school that’s going to cost too much.

More Reading:

The Real Cost of Attending an Expensive East Coast University

Anatomy of a Stingy College and a Generous One

Financial Aid Chances with a 2.9 GPA

Lynn O’Shaughnessy is the author of The College Solution and she also write a college blog for CBSMoneyWatch.com and US News.