Many financial aid letters — heck almost all of them — are confusing.

I’ve always wondered why award letters are so difficult to understand. Perhaps the staffers generating these letters in the bowels of universities have been conversing in financial-aid speak for so long that they have lost their ability to communicate in standard English.

Of course, the cynical explanation for unhelpful financial aid awards is that many schools don’t want families to know when an offer is pathetic. Obfuscation is an effective way to keep parents off balance.

This week I got the opportunity to listen to a great webinar on deciphering financial aid letters that was sponsored by the National College Advocacy Group. The presenter was Paula Bishop, a CPA in Bellevue, WA, and a friend of mine, who has looked at hundreds of financial aid awards for her clients.

What Should Be in Every Financial Aid Award Letter

Here are the basic components that Bishop says should be in any financial aid letter:

- Full cost of attendance. This should be broken down into such expenses as tuition, room and board, textbooks, travel.

- Grant and scholarships. This money doesn’t have to be repaid.

- Types and amounts of loans. The loans should include the interest rates.

- Net amount student will have to pay after financial aid is deducted.

- Parent and student’s expected family contribution.

What was particularly helpful about the webinar is that Bishop shared examples of aid awards she has reviewed. I wanted to share one example today and tomorrow I’ll provide one or two more. Once you see actual award letters, you will have a better shot at understanding what your aid letters mean.

George Washington University

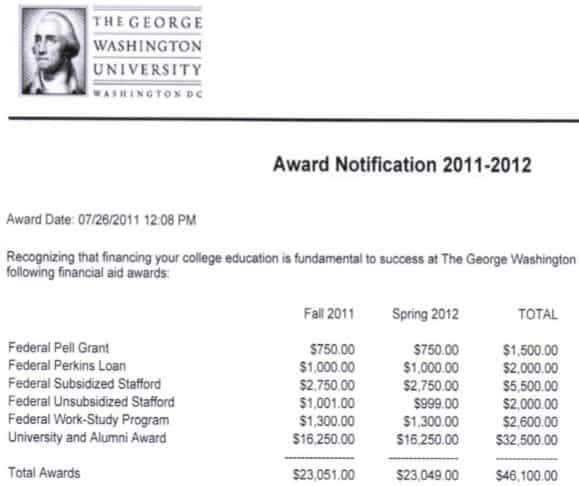

Today’s award letter comes from George Washington University in Washington, DC, which is one of the most expensive schools in the country.

Take a good look. Does this appear to be a good award letter? Do you see anything missing from the award?

Oops. What’s Missing

At first glance, this might look like a generous award. It appears that the family will be getting $46,100, which sure seems like a windfall. The

One whooper of an omission is GWU’s cost of attendance, which is a hefty $58,690. The letter also doesn’t include what the family’s Expected Family Contribution is. The EFC is what a family, at a minimum, will have to pay to attend a school. If you need it, here is an EFC backgrounder:

What Is Your Expected Family Contribution?

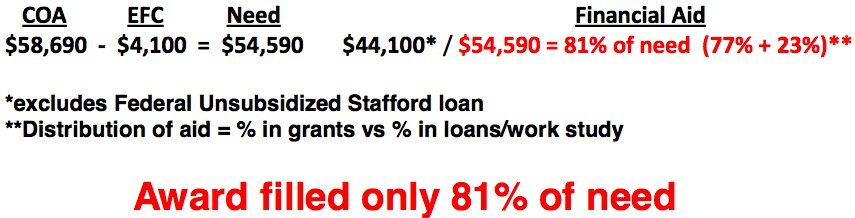

Paula explained that this family’s EFC is low — just $4,100. Ideally, the family would only have to pay $4,100 to attend any school. Realistically, however, most students will have to pay more than their EFC, but the closer to this figure the better. In this case, the family’s need was $54,590.

The GWU award also included an item that schools should not be inserting in their packages, but typically do — the federal unsubsidized Stafford Loan. Any student can qualify for the Stafford Loan (interest rate 6.8%) and it hardly should be used by aid packagers to reduce a family’s obligation. The subsidized Stafford and the Perkins are more attractive loans that middle and lower-income families can qualify for so it’s legit for those to be in the package.

Paula didn’t mention this, but what I find appalling is when schools, including GWU, don’t identify the Stafford as a L-O-A-N. How are parents supposed to know what a Stafford is otherwise??

Crunching the Numbers

When Paula removed the unsubsidized Stafford Loan from the package, the award dropped to $44,100. Remember, the student’s financial need is $54,590. Here is how she broke down the award:

GWU met 81% of this student’s financial need, but nearly a quarter of the package was in loans and a small work-study job. This is not a great award, but you need to compare it to what the students normally receive at GWU. For that you can head to the College Board and look at GWU’s financial aid statistics. Here is what I found:

According to GWU’s self-reported statistics, the school typically meets 94% of a student’s need. (See 6th line.) So the aid award that Paula’s client received would be lower than what many students attending GWU pocket.

As an aside, I wonder whether GWU really meets 94% of its typical student’s need. If it did, then the students who borrowed for college wouldn’t be graduating with an average debt of $32,714. (See bottom line in the above illustration.) That indebtedness figure is well above the national average of roughly $23,000. In calculating that 94% figure, my guess is that GWU wrongly counts loans as meeting a child’s financial need.

What’s more, GWU’s peer institutions, such as NYU (69%), Fordham ( 78%), Emerson (70%), Drexel (61%), Northeastern (69%) – all private universities in major East Coast cities – are typically meeting a far lower percentage of need for their students. Is GWU really going to be more generous than it’s competition?

These East Coast schools, by the way, can get away with lousy financial aid packages because there is such a big demand for students to attend schools in these cities.

I wrote a story about this phenomenon last year:

Attending Expensive East Coast Universities

Bottom Line:

You need to go through all the steps that I just outlined when analyzing a financial aid award to make sure you are getting what you think you are. Here is the next post on this topic:

Are These Financial Aid Letters Misleading?

Lynn O’Shaughnessy is the author of the second edition of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price. The second edition contains about 90% new content including chapters on evaluating schools financially and academically.

Lynn, If your student is looking at a 100% financial need met school and there is a gap between their EFC and the actual cost, isn’t the 100% financial need met school supposed to cover the difference?

You said, “Realistically, however, most students will have to pay more than their EFC, but the closer to this figure the better.” but isn’t that for schools that are not need blind?

Does it matter if the EFC is calculated using the Fafsa, IM or FM formulas?

What if all formulas are checked and there is a significant ($20,000) difference from what the need blind school calculator offers?

Unfortunately, I think I know the answer but I am wondering what your opinion is. Thank you.

I work in admissions and financial assistance and appreciate your perspective and very candid assessment of this particular award letter. However, I question your opinion that the Federal Stafford Loan should not be considered as a resource that contributes to meeting a family’s/student’s financial need. I think what you seem to suggest is that the Federal Stafford Loan should be a tool for financing and reducing out of pocket cost for those with less demonstrated need and then should be a bonus for less affluent families and that colleges should meet a student’s/family’s full financial need in gift assistance (which, of course, is typically unfunded aid or better described as foregone tuition dollars).

While I value your opinion on this matter and believe there is plenty of room for discussion, I believe you will find that the Federal Stafford Loan is often the first thing plugged into a need-based financial aid package as an available resource for meeting financial need. You seem to suggest that this is some awful practice. However, I think with careful examination you will and your readers will find that this is a common, ethical, balanced, acceptable–and often welcome practice. I don’t think there is much evidence that suggests that the Federal Stafford Loan was developed to “be in addition to” gift aid offered. I think the reverse is more accurate.

It was developed and increased over time to help a student/family cover the costs of attending college. I think you will find that there are plenty (probably the majority) of colleges that would use the Federal Stafford Loan to meet need for a family that has demonstrated need of $5,000 or less. What you’ve posited is that a college should meet the $5000 of need with a grant or gift assistance and then allow a student/family to use the Stafford Loan to further reduce the out of pocket cost. I don’t think this is the intent of the program. Furthermore, in the world you suggest, one could imagine a case in which a student annual cost to attend an institution is less than $5500 and they have an EFC of $1,000, that the college is responsible to offer the student a grant of $4,500 an then allow them to borrow the full amount of the Stafford Loan for what? Or, I guess, you might suggest this is good because a less affluent student does not have to borrow as much.

While in a perfect world, it would be great if students/families did not have to borrow as much as they do. But, higher education, financing higher education, willingness to pay, ability to pay and millions of other things make higher education far from a perfect world.

Respectfully,

Kent Barnds

Lynn, you did not pull any punches here and it is most appreciated! As students hear back from their colleges, I have to play the “doubting Thomas” role to make sure that their offers are as strong as the bottom line number would lead them to believe. You are always my “go to” advice column and I can’t wait to hear you at the HECA conference in June!

Kathryn,

Thanks for the kind words. I am looking forward to going to the HECA conference in New Jersey. That reminds me, I better get my plane reservation.

Lynn O’Shaughnessy

Lynn,

Nice article and one that I feel is important for families to see. I’ve seen award letters with four years of a grant on one page… making the family so happy to see this huge award! Only to read the fine print and realize Freshman year only gets 1/4 of that amount!

As I read the article, I think there’s one other thing that’s “missing” from the assessment – George Washington Univ. uses the CSS Profile in addition to the FAFSA form in determining a student’s aid eligibility. As you and I know, that can mean that the EFC from the FAFSA can be completely different from the EFC the Profile (or rather, the internal calculators at GW actually come up with!).

So when GW says they meet 94% of the average student’s need, they could very well be telling the “truth” by basing that percentage on what they deem the actual “need” is. Of course, they’ll never tell a family what the EFC really is, but that’s unfortunately how it goes at “Profile” schools.

Another note – their “competition” at Drexel and Northeastern always seem to offer much lower aid percentages because they are both co-op schools where the financial aid offices expect the students to make more money than regular students…. and thus (in there minds), those students don’t “need” as much financial aid.

Glad they asked the students what they need, huh?!

Thanks for writing about this one and getting people to “pay attention to the man behind the curtain!”

Todd,

In response to your comment regarding the University’s CSS Profile requirement, I wanted to chime in and say that students no longer need to fill out the Profile to apply for aid. I am currently a senior at GW and I have not had to fill one out since 2007, at which time I was applying to the school. I have to commend GW for making an effort to streamline their financial aid application process.

Schools also need to spell out if a grant /scholarship is good for 4 years and what a student must do to retain it (maintain a certain GPA, for example).

Another thought regarding loans, specifically how much is too much? The for-profits are notorious for burdoning students with too much loan… and their default rates verify their graduates inability to earn the income needed to meet the loan obligations.

A good rule of thumb is to consider what the annual salary of a recent graduate is expected to achieve within the program of study the student is considering. The total loan amount over four years (or however long it takes to graduate… six is becoming more common) should not exceed what the student is anticipating to earn in their first year out of school.

Awesome summary Lynn. Keep it up!

Glad you liked the post Rob.

I also agree that students need to be very careful about what they borrow. I’d suggest they borrow no more than what the Stafford Loan limits will allow. I’d stay away from private loans.

Lynn O’Shaughnessy