Financial aid awards are often confusing.

Plenty of colleges and universities intentionally make financial aid awards hard to decipher to trick families into thinking that their institutions are being generous even when they aren’t.

Obfuscation is an effective way to keep parents from effectively evaluating a financial aid award.

Since we are in the season of financial aid letters, I wanted to show you how you can easily analyze a financial aid letter.

What Every Financial Aid Letter Should Contain

Here is what a good financial aid letter should contain:

- Full cost of attendance

- Grants and scholarships.

- Types and amounts of loans.

- Net amount student will have to pay after grants/merit scholarship deducted.

- Parent and student’s Expected Family Contribution

Most financial aid letters don’t include all these elements, which truly is an outrage. If you find a financial aid letter incomplete, you should contact the school and get the missing information.

Check the EFC

I want to especially encourage you to obtain your Expected Family Contribution from the college.

Your EFC is what the financial aid formula says your household should be able to pay for one year of college. If the EFC isn’t provided and it usually isn’t, you YOU CANNOT DETERMINE if the award is a fair one or not.

Here’s a quick background on what an EFC is:

Expected Family Contribution: 10 Things to Know

Evaluating a Financial Aid Letter

I’m using a financial letter that a parent sent me several years ago from Pace University that beautifully illustrates why knowing an EFC is critical when evaluating an award letter:

What’s Inside This Financial Aid Award

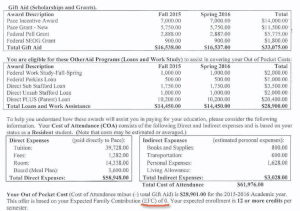

When I first saw this letter, I thought Pace University had not included this family’s EFC in the letter. I later saw that it was at the very bottom of the award without including an explanation. (I underlined it in red.)

It would have been very easy for the parents and the student not to know what this EFC figure was or why it was so important.

Before I share what the significance of this figure is, let’s take a look at what Pace was offering and not offering.

Gift aid. Pace gave this student $33,075 in grants and scholarships. In the award, $7,575 of this assistance came from the federal government (Pell and SEOG grants).

Loans and work study. After the gift aid was deducted, this student would have been expected to pay $28,900 for one year of college since the total cost of attendance was $61,976.

Evaluating this financial aid award: the verdict

Was this is a good award?

You might think so since $33,075 sure looks like a lot of free money. But in reality, this is a terrible award. The reason why I know this is because the aid letter includes the family’s EFC.

This student’s EFC is $0. This means, according to the formula, that she has the financial ability to pay $0 for college. Students get an automatic EFC when their adjusted gross income is $26,000 or less.

Pace was asking this impoverished student to pay $28,900 for one year of school. Clearly that would have been financial suicide for this low-income family to take out loans to cover this cost.

In contrast, someone with a higher EFC could have been thrilled with this type of assistance.

Let’s say a wealthy student with an EFC of $60,000 applied to Pace and got a merit award of $25,000 a year. Thanks to the merit award, the student would be paying far less than what his or her household EFC suggests the family could pay.

Know Where to Find an Applicant’s Official EFC(s)

There are three ways to identify the relevant EFC.

No. 1:

Ideally, the EFC will be included on the award letter. All schools should include this all-important figure, but as I’ve mentioned they often don’t.

No. 2:

Families can obtain the federal EFC from the federal government.

When a family files the Free Application for Federal Student Aid (FAFSA), the formula generates its official EFC. All institutions will use this EFC to determine eligibility for federal and state aid. The vast majority of colleges will also use this figure when determining whether an applicant will qualify for their own institutional aid.

A household will discover what its federal EFC is typically three to five days after filing the FAFSA electronically. That’s when they will receive a federal document called the Student Aid Report (SAR). The EFC will be displayed in the top right-hand corner of this document.

No. 3:

A household’s EFC can vary for schools that also use the financial aid application called the CSS Profile. About 200 colleges, nearly all private, use the Profile information to generate its institutional EFC for a household. This EFC is used to determine which applicants will qualify for a Profile school’s own financial aid dollars.

Profile colleges can personalize their aid formula by choosing from hundreds of optional questions, which means that each institution can generate a different EFC. Often these EFC figures will be quite similar, but there can be outliers.

If a Profile school does not provide the EFC on the award letter, you should contact each Profile institution for its EFC number.

Appeal based on the EFC

Once parents have their relevant EFC, they can appeal an award that is a disappointing one. It’s a buyer’s market at many colleges so appealing an award that an EFC indicates is inadequate can definitely be worthwhile.

Resource for Evaluating a Financial Aid Award

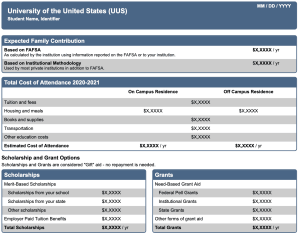

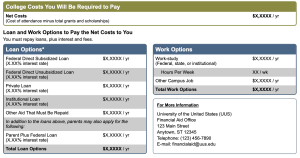

The best way to get up to speed on evaluating a financial aid award is to use a handy cheat sheet that shows you what a model award letter looks like.

The federal government created the cheat sheet, which is called the College Financing Plan. Until recently, it was called the Shopping Sheet. (See below).

As you can see from the screenshot of the model letter, the EFC is prominently shared at the top. With the cheat sheet, there will be no confusion about what line items are loans versus free money.

Also importantly, the award letter shares what the family’s net price would be.

The federal government would like all schools to use the template for their award letters, but many colleges have stubbornly continued to use their own flawed ones.

Bottom Line:

When a financial aid letter is incomplete, make sure you get all the information you need before making any decision about where your child will attend college and what you can afford.

And remember, you can always appeal an award!

Learn more:

The best way to lower your college costs is to become an empowered college shopper. The best way to become one is to enroll in my online course, ![]() The College Cost Lab.

The College Cost Lab.

Hundreds of high school counselors and independent college consultants have also enrolled in The College Cost Lab.

Can someone write an article for parents who are middle income retired, that qualify for no financial aid and only unsubsidized student loans? After paying our medical we have very little left for her housing, books and tuition. We are working minimum wage jobs to add to our pension. So stressful and there is no one to assist with how to manage as the school told me ‘I could make payment’ it is crazy.

Lynn, can you clarify how it is determined whether a student is offered a federal loan? Our EFC is too high to help (over $100K), but we’re hoping my son will get a work study, federal loan and merit. Is each college given a federal loan budget to divide among students or how does that work?

Note, he is applying to small, liberal arts colleges where his stats put him in the top 25%, and they all offer nice merit – you’ve set us on the right path!

Thank you for your guidance!

Author

Hi Julie,

Any student,who attends college at least half time, can obtain a federal student loan. Your income doesn’t matter when it comes to getting a federal loan. A student can obtain a federal Direct Loan up to $5,500 for the first year, $6,500 the second year and $7,500 for third, as well as fourth year. If an undergrad is in college for more than four years, he/she can borrow up to $31,000. I hope that helps.

Lynn O’Shaughnessy

Families can see their EFC as soon as they submit their FAFSA. Once they hit submit they will be given a confirmation that contains their EFC. They do not need to wait until they get their SAR.

For proper balance in reporting, it would have been appropriate to note in the article that Pace includes all of the elements, according to the author, a “good financial aid letter should contain” (The Federal Dept. of Education and NY State Higher Education Services Corp. recommend the same and go further to advise institutions to differentiate between gift aid (Scholarships and Grants) and Loans, which Pace does:

Full cost of attendance

Grants and scholarships.

Types and amounts of loans.

Net amount student will have to pay after grants/merit scholarship deducted.

Parent and student’s Expected Family Contribution

Unfortunately, the author of this article did not bother to share that most institutions (including the Federal Department of Education) advise students and parents that the Expected Family Contribution (EFC) does not mean the student/parent will only be required to cover the amount indicated in the EFC. The EFC is a fairly recent term, which replaced PGI, which stood for Pell Grant Index. PGI, in my opinion, was a better term because it correctly identified what the figure truly represents and does not confuse the student/parent by eluding to student/parent expected college cost contribution.

Another element that is missing from this assessment, is the booklet that is sent along with the award notice from Pace, that more clearly addresses federal terminology, student/parent expectations, alternative resource options, steps to actualize offered aid, etc….

ln fact, Pace University’s award letter has been considered, in other very reputable and thorough evaluations/articles, to be one of the better award letters, including many of the federally suggested best practices.

Good content.

I just wanted to say that if a student has a EFC of $60,000 that does NOT mean their family is wealthy. As a 1st generation college student, our EFC was $50,000 and we were far from rich but we did come from a 2 parent household with both hardworking parents. EFC did not take into account medical expenses from my mothers cancer treatments, car payments, mortgage and other daily living expenses needed to function.

Thank you!

Thank you, Lynn.

Excellent info for counselors and families!

Excellent, Excellent information!! Thank you so much!! Will definitely share with my students!