As I’ve mentioned in previous college blog posts, net price calculators allow you to obtain a personalized estimate of what a school will cost after deducting any scholarships and grants that your child might be receiving. Before you let your child apply to any colleges, make sure you have used each school’s net price calculator.

Unfortunately, not all calculators are worth your time. About 53% of net price calculators are mediocre because they use the federal calculator template. I got that figure from Abigail Seldin over at College Abacus, a valuable website where you can access thousands of net price calculators. Here is a previous post that I wrote about this free site:

College Abacus: A One Stop Shop for Net Price Calculators

Today I want to explain how you can spot lousy net price calculators. Schools with lousy calculators largely depend on the federal template rather than designing their own calculators or using an outside vendor such as the College Board.

Old price figures

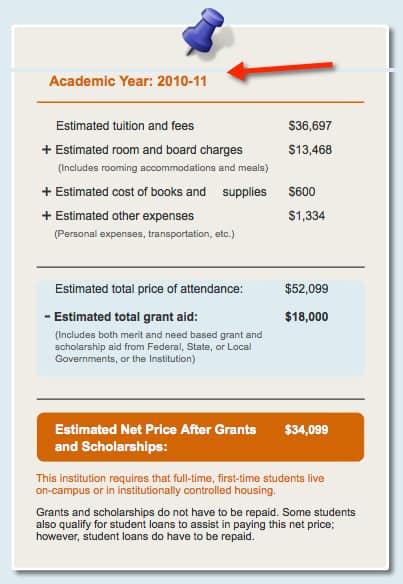

The whole point of using net price calculators is to pinpoint, as close as possible, what the real price will be for a family. That’s not going to be possible if the school is publishing musty, old price figures.

When obtaining your child’s net price at a school look at what year these cost figures originated. Here is an extreme example from Hampshire College, a liberal arts college in Amherst, MA, that uses the federal template. This is what I saw when I used Hampshire’s calculator today:

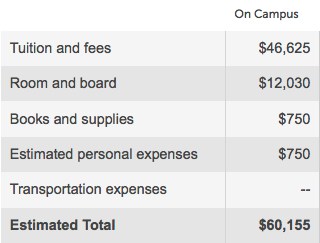

Shamefully, Hampshire College’s net price calculator is using four-year old data. While the school’s net price calculator uses $50,945 as the total cost of attendance, the cost for the fall of 2013 is $9,210 higher! I pulled Hampshire’ College’s current costs that you see below off the College Board’s website.

Shamefully, Hampshire College’s net price calculator is using four-year old data. While the school’s net price calculator uses $50,945 as the total cost of attendance, the cost for the fall of 2013 is $9,210 higher! I pulled Hampshire’ College’s current costs that you see below off the College Board’s website.

Why Use Misleading Prices

If Hampshire used current figures it would probably scare off some potential students, but it’s outrageous that the school is relying on ancient figures. Can you imagine the outcry if car dealers slapped sticker prices on their cars that showed the vehicles were $10,000 cheaper than they actually intended to charge?

You can also see above that the school has low balled the expenses beyond the tuition/fees and room/board. For instance, Hampshire says students at their school will incur no transportation costs even though 80% of the college’s students come from outside Massachusetts.

Some schools use realistic figures for these secondary costs while others like Hampshire try to minimize them. That’s why I like to compare schools strictly by tuition and room/board so you can get accurate comparisons.

Inaccurate Calculators

While Hampshire represents an extreme case, the cost figures for schools that use the inferior federally-inspired calculators are going to be at least two-years old and I’ve found that the figures are often even older. It’s a mystery to me why the feds provide such dated numbers when the schools themselves have the right figures.

Here is an example that I got today from Carnegie Mellon University’s net price calculator, which uses the federal template:

Who Uses Inferior Calculators

The schools most likely to use the federal template are less selective state schools, but there are some notable exceptions. Selective schools that use the inferior calculator include:

- American University

- Baylor University

- Brigham Young University

- Carnegie Mellon University

- Colorado School of Mines

- Georgia Institute of Technology

- New York University (slightly modified)

- Pepperdine University

- St. Mary’s College of Maryland

- University of Connecticut

Beware of Inadequate Questions

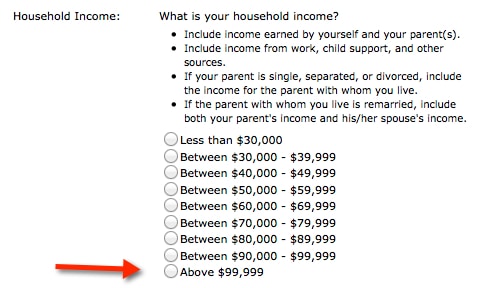

The aim of the federal template was to make using it as easy as possible. That’s admirable, but you can’t just ignore important questions in the process. Here’s one tip off that you are using a federally-inspired calculator — it should only take you 30 seconds or so to complete it.

One of the big problems with these federal calculators is that they don’t ask for a family’s actual income from income tax returns. Instead these calculators just ask for ranges. And strangely enough, the highest income range is just “Above $99,000.” This simplistic calculator also doesn’t ask about parent or child assets!!

Here is an example of the income question from Baylor University net price calculator:

Calculators That Completely Ignore Merit Aid

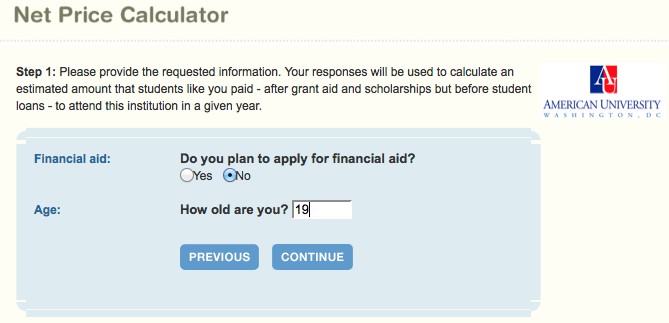

Another knock against the federal calculators is that they are worthless if you are not seeking need-based financial aid. If you answer “no” to that question, the calculator immediately stops asking questions and instead produces a cost figure that’s based on just two factors: you are not applying for aid and your child’s age.

Using American University’s net price calculator, I answered the following two questions before getting an estimated net price:

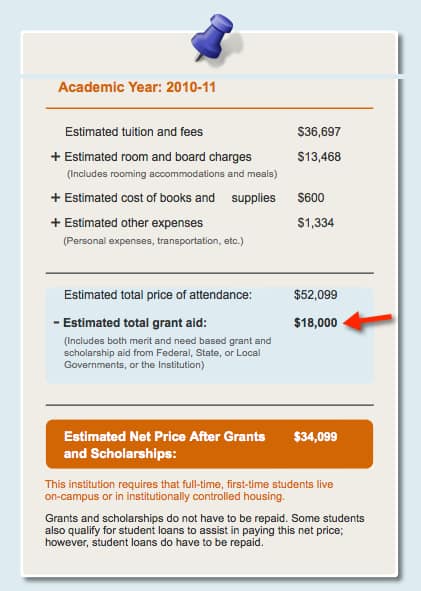

Based on answering the above questions, American University said I would receive an estimated award of roughly $18,000. How the heck did the school generate that figure? And how could anyone take this calculator seriously? (Also note the ancient cost figures.)

Based on answering the above questions, American University said I would receive an estimated award of roughly $18,000. How the heck did the school generate that figure? And how could anyone take this calculator seriously? (Also note the ancient cost figures.)

A Battle for Net Price Calculator

Finally, I wanted to mention one more disheartening development. As I’ve mentioned previously, I think College Abacus, which received funding from the Gates Foundation, is a wonderful resource to use net price calculators. You can go to individual school sites to use net price calculators, but they are often hard to find – sometimes intentionally so! This isn’t an issue if you access them through College Abacus.

Unfortunately, Rezolve, a major creator of net price calculators for schools (not the federally inspired ones), has abruptly decided to block College Abacus from accessing the calculators for roughly 400 schools. This is shameful behavior and the CEO’s reasoning for doing so just doesn’t add up.

Families need more access to these calculators (at least the worthwhile ones) not less. It’s unconscionable what Rezolve is doing.

Lynn,

I thought you would find it of interest to know that the Net Price Calculator is no longer the only tool available to students for estimating the cost of their college educations. While these calculators are vital tools, they can be time-consuming, and so are ordinarily utilized during the final decision-making phase of the college search process. At that point, many students may already have eliminated some of the nation’s best schools under the assumption that they would be unaffordable, not realizing that these schools may actually have been within their reach.

Wellesley College has introduced a new college cost estimator called My inTuition. Developed by a Wellesley economics professor, this Quick College Cost Estimator provides students with a realistic range of what they could expect to pay for an education at Wellesley with only six straightforward financial questions. Although developed for Wellesley, its results are applicable to many similar colleges that employ need-blind admissions. For families’ convenience, it is also available in a Spanish version.

This tool is a great way for families in the initial stage of the search process to explore the possibility of a top-tier school. I invite you to check it out at http://www.wellesley.edu/admission/affordable/myintuition.

Thanks Alice for sharing what Wellesley is doing to get out the word about its prices.

Lynn O’Shaughnessy

College Abacus is not accurately replicating or mirror these colleges’ NPCs.

Instead without the colleges’ permission, it is scraping and manipulating colleges’ financial aid algorithms and other code (intellectual property) that generates NPC results, and representing it as real, accurate results. However College Abacus’ manipulation of this data can produce inaccurate aid and price information for prospective college students.

(Imagine Lynn, if someone without your permission scraped your website, taking your hard work (your intellectual property and copyright), changes it in ways that can make it display your posts inaccurate, and presents your work to others as the real thing and to make money for themselves?)

In addition, when College Abacus’ efforts to take a college’s NPC code and other data without permission fail, it tells students that the college’s NPC is not operational when in fact the NPC is working perfectly well on the college’s website. (It could simply show the real link to the real NPC. Instead it has misinformed students.)

College Abacus has claimed that is aggregation of (unauthorized) NPCs saves students time. However when this business scrapes, mines and manipulates data without authorization it can actually increase the time it takes users to get results, which can be inaccurate.

You did not contact Rezolve Group and its custom NPC company Student Aid Services about this situation before making a judgment.

As a technology provider, Student Aid Services’ role is to provide net price calculators that meet the needs and requirements of our college and university clients (and the federal government’s). Colleges have legal terms of use for their NPCs that include not aggregating data and using it for purposes other than individual college planning by the NPC user. If Student Aid Services’ clients want to modify their terms of service to allow data mining and aggregation that is their prerogative. The issue is one for colleges and universities as they set the terms of use for their calculators – it is their data after all. The issue is not about College Abacus per se, but once one firm can scrap/mine/aggregate data from a college NPC, there will be pressure to allow any firm, regardless of business model, to access the same data.

A spokesperson for the U.S. Department of Education this week said the department is looking into what College Abacus is doing and that:

“We continue to believe that correct and consistent information that is easy to find will make it easier for millions of students and their families to compare postsecondary institutions.”

Student Aid Services’ is aligned with the U.S. Department of Education in its belief and supports providing students correct financial aid and net price information from authorized net price calculators.

For a year, College Abacus has been trying to take/mine/scrape SAS college clients’ intellectual property so it can sell to prospective students comparisons of 200 colleges, which receive top-rankings by US News & World Report. College Abacus’ original money-making plan, until it changed its website lat the end of October 2013, also was to sell colleges their competitors’ financial aid algorithms and sell back to colleges whose NPCs they took, the student data it gathered as lead generation for enrollment campaigns. Why support this type of venture?

Mary:

Nothing you say changes my mind one bit about what Student Aid Services/Rezolve is doing. I am appalled at the company’s behavior and it’s desire to block consumers from being able to compare net prices of schools. Your clients like Yale, Washington U. in St. Louis and Middlebury didn’t even want your company to block College Abacus from providing net prices to families from their schools.

The Department of Education is eager for families to be able to compare schools easily. It will be interesting to see what the department has to say about your efforts to make it harder. I’m sure it won’t be good.

Lynn O’Shaughnesy

I have to agree with Lynn on this one. While you may not like you system being mined for data, the truth is schools have a duty to publish the data as a requirement for taking financial aid dollars.

With that in mind, it doesn’t really matter who processes the data; it is required to be available. Just because a site aggregates it and allows for comparison doesn’t make it inaccurate because you don’t approve of the method of collection or presentation. As for authorization, many schools work hard to bury their stats to hide the actual cost. Price comparison is the only way to shake out a market and force it to control costs.

Thanks Jose. I agree with everything you say about this. I’m still scratching my head over the over-the-top reaction from the net-price-calculator vendor. What’s important is families having access to pricing information.

Lynn O’Shaughnessy