As recently as the early 1990s, most students did not take out college loans. Today about two out of every three students borrow to pay for college.

One reason for the dramatic change is this fact: during the last-quarter century, tuition has risen four times faster than the consumer price index.

The typical student borrower is now leaving school with debt of roughly $25,000. Add it all up and the outstanding student loan burden now exceeds credit-card debt, which seems unfathomable to me.

Is $25,000 a reasonable amount of student debt?

It depends on what type of student loans an undergraduate is using. The level of debt will be more manageable if the student only borrowed through federal student loans. For most students that will mean obtaining federal Stafford Loans.

Federal Stafford Loans

Many parents are confused about what loans to use. When I give college talks, I notice that parents tend to grab their pens when the subject turns to loans. Consequently, this week I’m devoting some posts on college borrowing and I’m starting with the best and most popular – the federal Stafford Loan.

Here is why the Stafford is superior:

- Students regardless of their income qualify for the Stafford if they are enrolled at least half time and complete the FAFSA.

- The loans have a fixed interest rate.

- Students receive the same rates regardless of credit scores.

- The loans offer a student repayment plan based on grad’s current salary.

- The loans offer a public service student loan forgiveness program.

The federal Stafford Loans are designed strictly for students. Borrowers must begin repaying these loans shortly after graduating or dropping out of college.

Stafford Loan Questions

Here are the answers to five common questions about Stafford Loans.

1. Are there different kinds of Stafford Loans?

Yes. There are unsubsidized Stafford Loans and subsidized Stafford Loans.

The best loan to get is the subsidized Stafford. Students who qualify for a subsidized Stafford Loan don’t have to pay the interest that accrues while the student is enrolled in college. The federal government pays for all this interest. Borrowers through the unsubsidized Stafford don’t get this deal.

For the past few years, the student loan interest rate on subsidized Stafford has been lower. The interest rate is currently 3.4%, but it is scheduled to jump to 6.8% on July 1 when the new student loan year begins. The student loan interest rate on an unsubsidized Stafford is 6.8%. Congress is currently fighting over whether the lower interest on the subsidized loan program should be saved. Republicans are against preserving the lower rate and Obama is making a full-court press to save it. You can learn more about the battle in this Inside Higher Ed piece today:

Yet Another Time Bomb

2. How do you know if you qualify for a subsidized Stafford Loan?

Your college will tell you. Look at the financial aid package that your college sends you. In the package you should see what the breakdown of subsidized versus unsubsidized Stafford loans are. The majority of subsidized Stafford Loans are awarded to students whose family’s adjusted gross income is less than $50,000.

A federal formula is used to determine if a student, based on a family’s finances, is eligible for the better subsidized deal. You may see both kinds of Stafford Loans in your package.

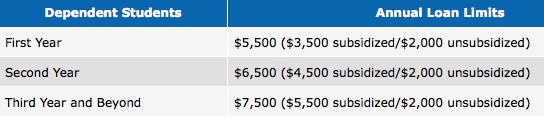

3. How much can I borrow with federal Stafford Loans?

Here is a chart that outlines the borrowing maximums for dependent students:

4. When should I apply for my federal student loan?

You can ask your college’s financial aid office, but the new year for federal student loans starts July 1.

5. What happens if I need to borrow more than the Stafford loan program allows?

Federal student loans are the superior loans — by far — for students who need to borrow, but there are limits to how much you can borrow. I’ll be covering other student and parent loan options soon.

Bottom Line:

Students should stick with federal students loans when borrowing for college. If at all possible, avoid borrowing more than the maximum amount generally allowed for the Stafford – $27,000.

Meet Me in St. Louis?

If you happen to live in St. Louis, I’ll be giving a college talk at Incarnate Word Academy tonight (April 23) at 6:30 p.m. in the multi-purpose room. I hope to see you there. Because the girls’ school is my alma mater, I’ll be giving everyone there an electronic copy of my workbook, Shrinking the Cost of College.

Lynn O’Shaughnessy is the author of the second edition of The College Solution: A Guide for Everyone Looking for the Right School at the Right Price.

Thank you for your information. I am several years away from my son going to college, but looking into what it will take to prepare financially. My question is regarding the yearly limits of the Stafford loan. From what I understand, the cost of my sons college is currently $21,000 for two semesters. This far exceeds the $5,500 limit. Will he need multiple loans , or another loan option? Can you assist me in what I may be missing?Thank you

Hi Mike,

Ideally the family should try to limit borrowing through the Stafford. A student should not be borrowing $21,000 a year!!

Keep in mind that two-thirds of students do not pay full price for college. The average discount at private schools across the country is 51%. The best thing your son could do to keep costs lower is to be the best student possible. Students with the best grades, who take a solid course load in high school are awarded with the best aid packages from colleges. I’d urge you to read The College Solution: A Guide for Finding the Right School at the Right Price, to learn much more about cutting the cost of college. Here is the Amazon link: http://www.amazon.com/College-Solution-Everyone-Looking-School/dp/0132944677/ref=sr_1_2?s=books&ie=UTF8&qid=1329264474&sr=1-2

Good luck.

Lynn O’Shaughnessy

Hi Lynn,

I found the information on how few students took out students loans in the early 90’s startling. My husband and I both graduated in the 80’s and maxed out our government loans going to state schools. I’ve assumed that was the case for most students but I guess not.

I’ve wondered why people are worried about $25,000 of debt at graduation. It seems a reasonable amount (if you do just the government loans) for a college degree. We ended up consolidating our loans (less than a car payment) and just finished paying them off as our son started college. Was it worth it? With our son’s Stafford loan and merit aid, we can afford his tuition at a private school.

I think there’s a lot of hysteria around college debt. We all read about the students with $100,000 or more in debt which is in no way justified. But it seems to lead to many thinking that they must avoid all debt. People don’t have a problem taking out a car loan and most don’t borrow enough to get the BMW rather than a Ford. People just need to become educated on the differences between colleges as they are about car brands.

Hi Michelle,

I am so with you on how people get too stressed out about borrowing a reasonable amount for college. My nephew, who is heading to college in September, falls into that category. I’ve tried to explain that borrowing through Stafford Loans is a great and, in his case, a necessary investment in his education.

Lynn O’Shaughnessy